Is Motley Fool a pump and dump scheme? Read on to find out our take on this elite stock market research provider.

Pump and dumps are pervasive in the world of trading, especially penny stocks. And with so many scammers on the stock market, many folks are even second-guessing household names in investment research like Motley Fool.

So today, we’re putting The Fool under the microscope, analyzing the firm’s investment strategy, disclosure policy, and past performance.

Let’s kick things off with a bit of background on The Motley Fool.

About Motley Fool

The Motley Fool is a research firm helmed by brothers Tom and David Gardner.

Founded in 1993, The Fool has built a name for itself as one of the premier purveyors of market analysis, chiefly in the form of newsletters with monthly stock picks. The firm offers free investment ideas through its blog on the Motley Fool website, but the main attraction is its paid services.

Some Motley Fool services include:

-

Stock Advisor

-

Rule Breakers

-

Motley Fool Options

-

And many more

Its Stock Advisor subscription is the firm’s most popular product, and it’s regarded as one of the best places to find quality long-term investments (The Fool’s specialty).

Now that you know more about Motley Fool, let’s clearly define what a pump and dump is so we can determine if Motley Fool falls in this category.

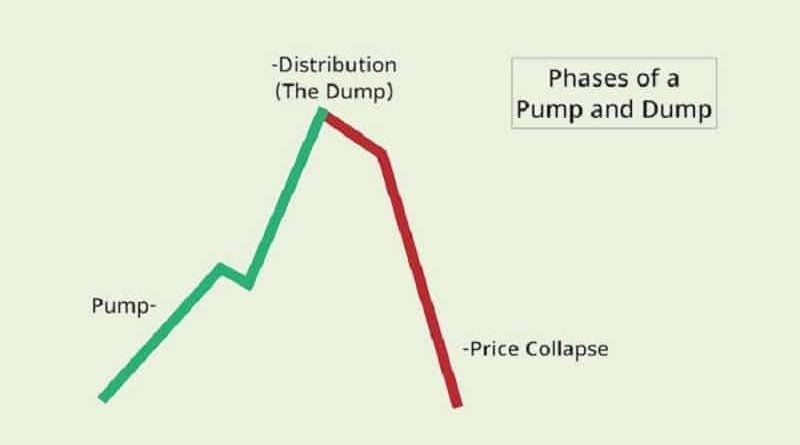

What Is a Pump and Dump?

In the simplest of terms, a pump and dump is a scheme where an individual, company, or group uses tactics to artificially inflate the value of a stock, with the intent to sell off to make a profit.

Many pump and dump schemes focus on micro-cap or small-cap stocks. This is because they are highly speculative, volatile, and easier to manipulate.

Here’s how it works:

-

Bad actors looking to pump a stock up hype up investing communities with misleading reporting, news, or fudging financial data. Unsuspecting investors rush to buy, increasing trading volume and price (this is the pump).

-

Once a stock’s value skyrockets, the pumper initiates a sell-off (the dump).

-

Unsuspecting investors are left holding the bag while the scammers move on to the next target.

Keep in mind that dumps aren’t always immediate: sometimes there’s a gradual decline in price while hype slowly deteriorates.

One last note, while penny stocks have historically been the target of pump and dumps, there’s a growing number of them in the crypto space.

How Do You Know if It’s a Pump and Dump?

Unfortunately, there is no way to know for sure if something is a pump and dump scheme, but there are some tell-tale signs you can look for:

-

Stocks Trading on Pink Sheets – These aren’t all scams, but you’ll want to be extra cautious trading with pink sheets. These companies aren’t required to rigorously report the same data as securities listed on major exchanges.

-

Flimsy Financials – If a company’s financials seem too good to be true, you might want to put its reports under a magnifying glass. Don’t fall for bare-bones, unverified financial disclosures.

-

Trading Volume – When you see an explosion of trading volume, you’ll want to check the stock charts and pinpoint a legit catalyst. If folks are trading just because they saw a vertical green line within the last 24 hours, the company may not have organic momentum behind it.

-

Social Media Storm – Many scammers take to social media to promote a stock and generate hype. If you see a lot of online chatter that’s telling you to buy stock now, it might be a scheme to rope in unsuspecting folks with little experience trading. Double-check to make sure the hype is backed by something tangible.

-

Sensational News – Many pump and dumps will release sensational news to trick an average investor into thinking that the company is on the verge of a breakthrough. Always verify claims instead of taking them at face value.

These aren’t the only indications of a pump and dump, but keeping an eye out for these signs can set you on the right track.

The Securities and Exchange Commission also has six rules to follow when you vet stocks. These include:

-

Don’t Believe the Hype

-

Find Out Where the Stock Trades

-

Independently Verify Claims

-

Research the Opportunity

-

Watch Out for High-Pressure Pitches

-

Always Be Skeptical

All of these are good insights, but the best bit of guidance is to always be skeptical. If you jump into your analysis from this perspective, it might be easier to catch on to iffy signals early on.

With that out of the way, let’s turn our attention to The Fool.

Is Motley Fool a Pump and Dump Scheme?

The short answer is that Motley Fool is not a pump scheme. The more interesting question, however, is how do we know this?

For one, most of The Fool’s plays are for the long term. In contrast, most pump and dumps revolve around short positions (get rich quick schemes), where a guru picks up a stock before making a call so they can cash in from a quick increase in trading activity.

Here’s a quote from Motley Fool that encapsulates its strategy:

“The Motley Fool’s approach to investing prioritizes buying and holding quality stocks for long periods of time. We focus the most on the business fundamentals of the companies in which we invest, rather than on their stocks’ short-term price changes.”

Also, Motley Fool has a strict disclosure policy to ensure its readers and patrons are in the loop about their analysts’ positions.

Here’s a list of the firm’s disclosure rules. Employees:

-

Must hold a stock they own for ten days

-

Are not allowed to write about a stock two days before or after buying or selling shares

-

Run trades through Motley Fool compliance

-

Must notify compliance whenever they trade a stock, even if they haven’t written about it

These are strong safeguards to ensure that the Motley Fool team is not using their platform to pump the price of a stock.

The Motley Fool has other transparency rules, but these are some of the most consequential.

So it’s clear that The Fool goes to great lengths to give folks a fair shake when investing.

But could the firm’s popularity unintentionally influence the market?

The answer is quite fascinating.

Does Motley Fool Influence the Market?

We scoured the web to find out whether Motley Fool stock picks have the potential to influence the market, and one of the best answers we found was a study published on ResearchGate.

It’s called “EVALUATING THE PERFORMANCE OF THE MOTLEY FOOL’S STOCK ADVISOR”.

We won’t bog you down with the details. But the study found that, between five Motley Fool portfolios, stocks recommended by the firm increased in price by an average of ~1.60% on the first day they were announced and about 3% during the picks’ overall runs.

This isn’t our study, so we can’t verify the veracity of the data. But if the findings are accurate, this is a minor increase compared to traditional pump and dumps.

So while Motley Fool’s stock picks could influence stock prices, it appears so marginal that it could hardly be considered a pump.

Is the Motley Fool a Reliable Source of Market Insights?

Based on the track records of stock-picking services like Stock Advisor, Rule Breakers, and Motley Fool Options, the team appears to have reliable insights into the stock market.

Many of these are long-term plays, which gives even more credence to the idea that the firm is not pumping and dumping stocks.

While not every pick is a winner, on average, they report some exceptionally positive results.

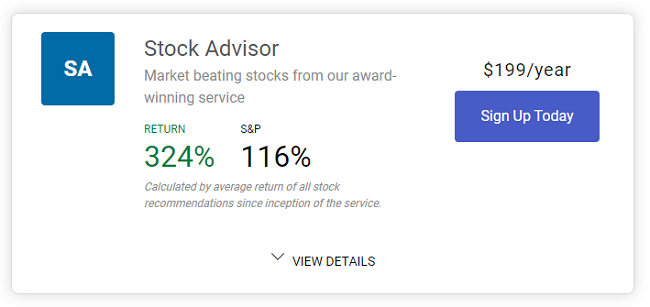

Motley Fool Stock Advisor Performance

Motley Fool Stock Advisor is The Fool’s flagship research service and has one of the best track records out of any of its other offerings.

Right now, Fool reports that the service’s average returns since its rollout are up about 324%.

During the same time, the S&P has seen a 116% return. That’s not too shabby, but Stock Advisor returns have outpaced it almost 3 to 1.

We’re not talking about just a few stocks, these are two decades worth of recommendations.

With average returns like this, it’s no surprise that the Stock Advisor service is held in such high regard.

If you want a full breakdown of this service, head down to our Stock Advisor review for more info.

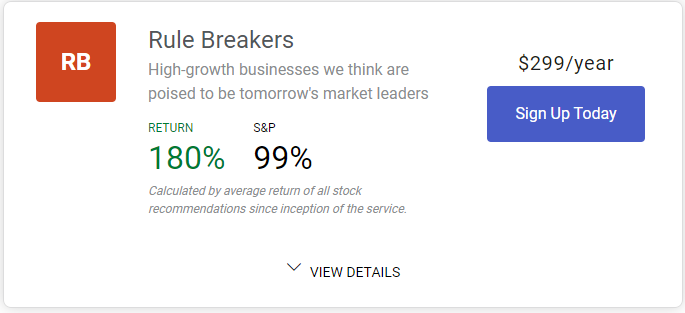

Motley Fool Rule Breakers Performance

The sister service to Stock Advisor, Rule Breakers, is the second-most popular offering from Fool.

Rule Breakers focuses on long-term plays with explosive growth potential. While the Rule Breakers strategy is admittedly riskier, it has still provided the potential for returns above the industry average.

Motley Fool reports that Rule Breakers has provided the opportunity for 180% on average since its inception.

The S&P 500 saw returns of about 99% during the same period, meaning that Rule Breakers has almost 2X it.

While, historically, these recommendations may fall short of Stock Advisor picks, this is a really impressive figure.

Something to keep in mind when comparing these two services is that these are average historical returns during their runs. There are years when Rule Breakers outperforms Stock Advisor’s picks.

If you want to know more, you can visit our Motley Fool Rule Breakers review for a deep dive into this stock picking service

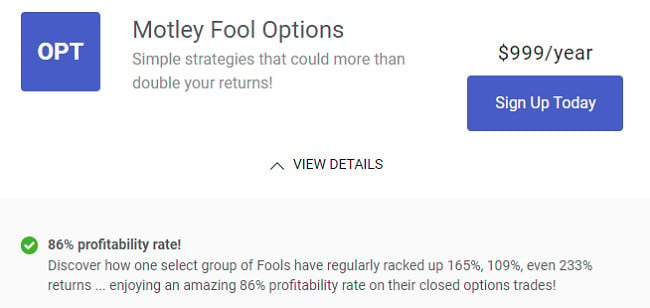

Motley Fool Options Performance

Motley Fool Options is a trading research service that offers subscribers an all-you-can-eat buffet of options education and stock picks.

Anyone with a brokerage account knows that options are risky business, and many opt-out of this trading strategy for safer returns.

Fortunately, like the other services we looked at, Motley Fool Options is reported to have a fantastic track record.

The firm reports that its picks for this stock recommendation service have an 86% profitability rate.

Options are a difficult strategy to master, so it says a lot that the firm has been able to lock in such a high profitability rate.

If you want to know more, you can check out our Motley Fool Options review for an in-depth breakdown of the service.

Is Motley Fool Worth Subscribing To?

Motley Fool’s services are worth the price, as few firms in the industry have earned such a solid reputation for transparency and market-beating recommendations.

So if you’re on the fence about becoming a Motley Fool subscriber, you’ll be relieved to know that this is a firm that puts a lot of care into each stock pick it provides.

Motley Fool’s stock recommendations won’t always end up in the green, but you can be confident that the firm is striving to deliver on its vision to “make the world smarter, happier, and richer.”

Tags:

Tags: