The Motley Fool and Zacks Investment are two online platforms that offer investment research to help build profitable portfolios.

In this guide, we’re breaking down the differences between The Motley Fool and Zacks Investment, so you can decide which service is right for your investment strategy and really see who comes out on top when it comes to The Motley Fool vs Zack’s.

Motley Fool and Zacks Stock-Picking Services

Motley Fool and Zack’s offer Stock Advisor-like services and premium participation levels for serious investors.

Though, Motley Fool and Zacks take a different approach to how they recommend stocks to subscribers.

Motley Fool’s stock recommendations tend to lean towards innovation, while Zacks looks at the top-performing stocks in various industries.

Outside of stock picking services, both Motley Fool and Zacks offer detailed research reports and an impressive track record.

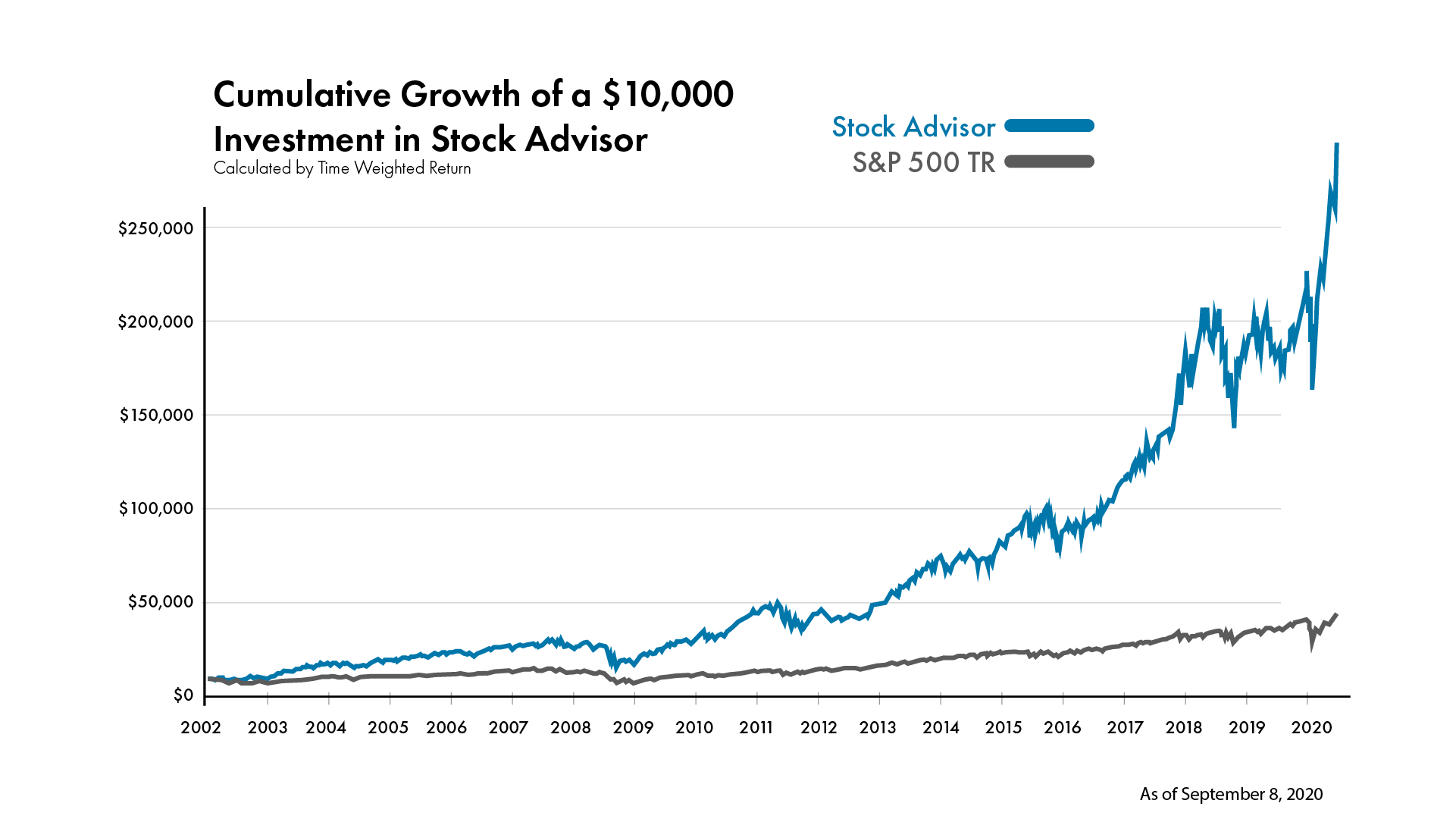

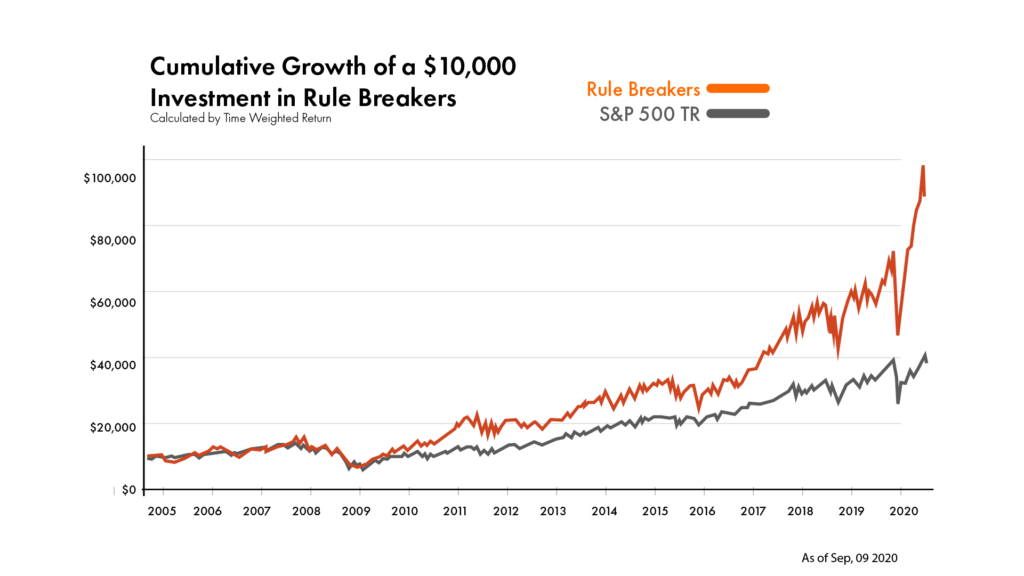

This should make you feel better about jumping onto either service because their results continue to outperform the S&P 500 year after year.

Not sure where you stand on the Motley Fool vs Zacks debate?

We can help.

We’re taking a close look at how both services offer investment advice, craft their buy recommendations, and perform fundamental analysis so you know what you’re jumping into.

Motley Fool vs Zacks: Overview

The best way to approach the Motley Fool vs Zacks debate is by taking a closer look at both companies.

Let’s start with The Motley Fool and founders Tom and David Gardner first.

About The Fool and Its Founders

Tom and David Gardner are the founders of the Motley Fool, a stock analysis company that specializes in providing several stock picks per month.

More importantly, the founders also invest in their new stock recommendations, so you can feel confident in their picks.

More on Motley

The premium Stock Advisor subscription plan is the company’s most popular service.

Motley Fool Stock Advisor offers free access to industry trends, stock research, research reports, retirement advice, newspapers, mobile newsletters, and a lively blog.

In addition to providing monthly stock picks, the company offers analysis on mutual funds, earnings estimates, and its other service rule-breakers.

Why New Investors Are Drawn to The Fool

As the company’s name implies, The Motley Fool prides itself on providing stock advice with a sense of humor.

The website platform makes financial investment a bit more entertaining and more accessible for novices who are just learning the ropes.

This is a proven formula that drives newcomers to the platform who are interested in learning more about personal finance and investing.

About Zacks, Zacks Premium and Its Founder, Len Zacks

Founded in 1978 by Len Zacks, an MIT Ph.D., Zack’s also offers options, ETFs, and mutual funds advice in addition to stock picks.

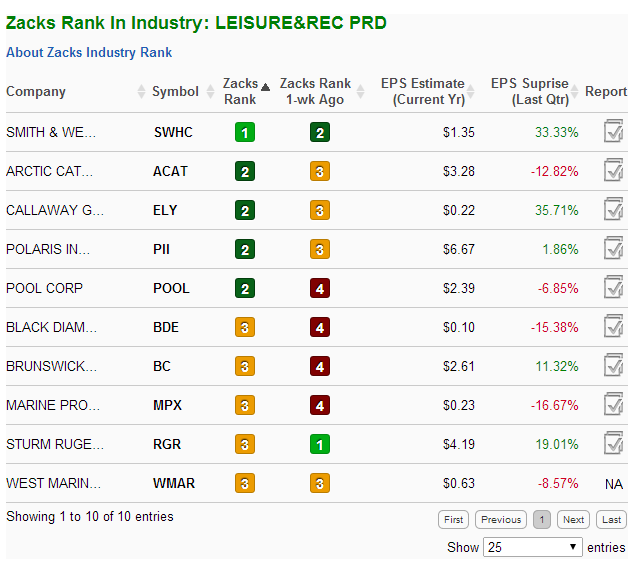

Like The Fool, Zack’s is an investment platform that offers stock picks to its Premium subscribers, but the system is built around earnings estimate revisions.

In particular, it looks at how increasing or decreasing earnings estimates will impact stock prices.

More on Zacks

The company has been around quite a bit longer than The Motley Fool and adapted to the digital world as it grew in the early 2000s.

While the system might seem more intricate, Zack’s also appeals to new stock investors who need simplified stock picks.

Zacks Premium services use a one-to-five ranking for stocks that are fundamentally strong and timed to explode.

In addition to using fundamental analysis to identify top-performing stocks for its Zacks Premium customers, the company offers both long-term and short-term trading advice.

The company researches and tracks over 1,050 stocks.

Motley Fool vs Zack’s: How Do They Work?

Now that we know a bit about Motley Fool and Zacks Premium, it’s time to take a look at how each platform works.

Before subscribing, you need to be sure that the platform you choose is aligned with your investment strategy.

Read on to learn more about each service.

Motley Fool Stock Advisor

While the Motley Fool Stock Advisor is its most popular Premium subscription, it offers a variety of subscription levels to subscribers based on the stock picks they are after and the analysis they prefer to see.

In addition, the company offers free and premium newsletters with information about investment opportunities, types, mutual funds, etc. — in an upbeat and humorous manner.

The Fool Service Breakdown

The Motley Fool leans heavily on its newsletter format along with its online website, which is accessible with any level of subscription.

The website posts top stock picks several times a month.

On occasion, The Motley Fool Stock Advisor level of access also sees a sell recommendation posted, but this is very rare.

Most investors are encouraged to act on stock picks and choose at least ten stocks to hold for three to five years.

So Motley Fool Stock Advisor is not necessarily an ideal platform for investors who want to make money on quick short sales.

The three most notable subscription levels for The Motley Fool include:

- Rule Breakers

- Stock Advisor newsletter

- 10x Portfolio

Most novice traders opt for The Motley Fool Stock Advisor and then move up to higher newsletters and stock picks as they become more comfortable with the platform.

Time to check out Zack’s.

How Zack’s Works

Zack’s Investment Research provides three Zacks Premium tiers of stock picks, but its largest tier is the Zacks Premium newsletter, which is on par with The Motley Fool’s Stock Advisor.

Zach’s Premium offers three Rs that are defined by the company as its cornerstones for Zacks investment research:

- Recommendations

- Reports

- Rankings

In addition to the newsletter that comes with Zacks Premium, investors also gain access to an online portfolio and tracker tool that allow them to see the ranking of each stock.

Ideally, investors’ portfolios will also feature Zacks 1 rank if they are capitalizing on the advice of Zacks’ list of the best stock picks.

Unlike The Motley Fool, which concentrates on providing stock picks and opportunities, Zack’s Premium supports its users by watching their stock picks and analyzing their performance.

How Zacks Premium and Zacks Rank List Work

Each day, subscribers can see news about their securities and view their current ranking.

The Zack 1 rank indicates what they should buy, while a ranking of 5 indicates a sell recommendation.

The simplicity of the system appeals to novice traders who like the non-complicated approach to navigating the stock market.

Though, despite its short-term trading recommendations, Zack’s does not recommend that inexperienced traders attempt a short sale.

In fact, Zacks considers itself a simplified stock analysis platform instead of a platform to buy and sell activity, like Wall Street.

Zacks 1 Rank List

To obtain Zack’s 1 rank, a stock needs to have several earnings estimates via analysts and qualify for a fundamental analysis recommendation.

Zack’s Rank list is a stock-picking strategy much different than The Motley Fool: Zacks focuses on the worth of all stocks in its analysis, while The Motley Fool focuses on mainly perceived growth stocks.

Stock Advisor and Zacks Premium Similarities

While there is a lot to say in the Motley Fool vs Zacks debate, Stock Advisor and Zacks Premium have similarities.

Both lean heavily on delivering stock picks via in-depth newsletters that are available to premium subscribers.

If information is what you’re after, then you’re in luck, as The Fool and Zacks investment research and recommendations are delivered via daily emails, breaking news, and the like.

Both platforms also offer free content and tutorials to their customers.

Zacks Premium and Stock Advisor Can Fill the Same Role but in Different Ways

Novice traders can feel comfortable with both The Motley Fool Stock Advisor and Zacks Premium subscriptions because they offer step-by-step guides and instructions.

Both also outline what their subscriptions deliver, so there are no questions or surprises once the initial payment is processed.

In addition, both The Motley Fool and Zacks Premium subscriptions have a strong record of outperforming the S&P 500, which means if you follow their stock picks and lean on their detailed research reports, you should increase your average return rate.

Though, Motley doesn’t have a ranking system like Zacks rank list.

Finally, both Zacks Premium and The Motley Fool’s Stock Advisor offer a 30-day free trial to customers so you can check them out and see if they fit your investment needs risk-free.

If you’re unsatisfied with the information and financial analysis of either, you can contact the respective company for a full refund.

How Motley and Zack’s Stand Apart

Although both companies offer premium services and stock picks, there are some major differences in the way that they operate and the analyst ratings they develop.

The Motley Fool tends to offer more narrow recommendations based on staff preferences — in particular the market niches that David Gardner favors.

On the other hand, Zack’s offers more quantitative stock recommendations.

Also, most of Zack’s analyst ratings derive from Wall Street stock market analysts and are much broader than The Motley Fools’ limited focus on growth stocks.

Zacks Rank vs Motley Fool Stock Picks

Zacks’ investment research is distilled in its one-to-five ranking system, which offers members a guide on how to continually reevaluate their investment portfolios and focus list.

On the other hand, The Fool stock picks are meant to develop long-term investment strategies that can take three to five years to profit from.

Motley Fool vs Zack’s: Plans & Pricing

Of course, price always plays a role in the Motley Fool vs Zacks debate, so let’s jump right in and see how the cost of these services match up.

Motley Fool

The Motley Fool offers two primary stock picking subscription services that both include access to an online platform and specialized newsletters with stock recommendations.

Stock Advisor

Motley Fool’s Stock Advisor is by far its most popular service.

It has a proven track record and offers two stock recommendations per month.

Each month, subscribers also receive a list of the top ten best stocks, and new investors receive starter stocks to boost their portfolio.

Stock Advisor costs $199 per year.

Rule Breakers

Rule Breakers also delivers two stock picks monthly, but its focus is identifying stocks that the company earmarks as high-growth businesses that are close to rapidly scaling.

The Motley Fool offers five top stocks from a carefully cultivated list of 200 stocks as well as access to community resources and starter stocks.

Rule Breakers is priced at $299 per year.

Other Services

In addition to these two flagship stock products, Motley Fool’s Stock Advisor and Rule Breakers bundle is a great choice for investors interested in growth stocks and traditional stocks — it’s priced at $498 per year.

The Fool also offers:

- Everlasting Stocks for $299 per year

- A Rule Your Retirement subscription designed to offer tailored retirement guidance for $149 a year

- Everlasting Portfolio that allows you to build an investment portfolio that mimics CEO Tom Gardner’s for $2,999 per year

Zack’s

Zack’s offers three main stock recommendation subscriptions that are supported by thorough research reports and delivered via newsletter and online platform.

Zack’s Premium

Most investors go with Zacks’s Premium newsletter, which is priced at $249 per year and includes both a regular newsletter and the My Portfolio Tracker Tool so investors can see the Zacks rank of their stocks.

In addition to receiving breaking news and securities rankings every day, the Premium service also includes analytical tools that traders can access for more information and the Zacks focus list, which tracks a list of 50 stocks.

In terms of pricing, Zacks Premium is close to Stock Advisor but about $50 more.

Zack’s Investor Collection

Long-term investors will want to look more seriously at the Investor Collection service, which is available for a monthly subscription of $59 per week.

The subscription includes buy and sell signals and capitalizes on growth stocks that start under $10.

Zack’s Ultimate

Zack’s Ultimate subscription is its top-tier option and offers:

- Features from all of the above-listed subscription levels

- Private picks from Zacks

- Portfolio recommendation services

- Exclusive market insights

- Innovative investment approaches

This service costs $299 per month.

Motley Fool vs Zack’s: Performance

In terms of performance, both the Motley Fool and Zack’s have a stellar track record and regularly outperform the S&P 500.

The two services are clearly headed by intelligent traders with a knack for picking the best stocks.

So most investors subscribed to either service will likely see a suitable average return if they follow stocks advice and suggestions.

In terms of technical factors, the two services both are clearly optimized and offer user-friendly interfaces.

Though, Zacks rank lists do provide a new feature that’s not offered by Motley Fool.

Motley Fool vs Zack’s: Pros and Cons

Motley Fool

Pros:

- 3–5-year long-term holding pattern

- Access to many free analysis tools and data

- Keeps ideas simple for novice investors

- Uses simple language

- Accessible Premium services

- Free trial period

Cons:

- Heavy focus on long-term investments

- Emphasis on growth stocks

- Focus on Next-gen companies

- Poor customer service

Zack’s

Pros:

- Appeals to advanced investors

- Offers both buy and strong sell recommendations

- Free trial period

- Their system is built around earnings estimate revisions

- Offers 1 rank list

- In-depth research

- Evaluates over 1,050 stocks

- Relies on Wall Street and independent research

Cons:

- Some aspects are too advanced for beginners

- Complex desktop platform

Customer Service

Motley Fool Customer Service

Motley Fool customer service is essentially DIY, although the platform does offer very accessible threads and a suburb FAQ section where most common questions are answered.

The community section is generally lively and can also be used to solve queries.

One downside is that the 800 number is only for services and subscriptions, and no questions about stocks or investment advice can be accessed via it.

Zack’s Customer Service

Zacks is extremely responsive to its subscribers and offers an active customer service line on weekdays from 9 am to 6 pm.

You can easily find the phone numbers and emails for all department heads, including its director of research.

Zack’s subscribers are encouraged to use the online form and ask questions.

Who is Motley Fool Best For?

The Motley Fool is best for novice and beginner investors because it breaks down the process and delivers small tidbits of information designed to streamline investment.

All Motley Fool stock picks are based on three to five-year holding periods, so starting investors are more ideal than those nearing retirement or ready to cash out mutual funds and ETFs.

The language of the website is simple, and the humorous tone of the newsletters and stock analysis blogs keeps subscribers lightly entertained while they learn how to trade on Wall Street.

Who is Zack’s Best For?

Zacks is designed to appeal to advanced investors who want the option to participate in both long-term and short-term stock investments.

Its strongest features include the buy and strong sell rankings as well as its easy-to-interpret one-to-five ranking system.

While the simplified Zacks rank system is accessible to novices, the in-depth research and wider stock net appeal more to educated investors and personal finance gurus.

Motley Fool vs Zack’s: Final Thoughts

Motley Fool and Zack’s both provide stock recommendation subscription plans that can deliver strong results.

Each service offers its own mutual fund, which allows you to see how they perform before subscribing.

Both companies also boast affordable entry-level subscriptions that can be used to build stock portfolios.

The Motley Fool Stock Advisor offers two stock picks a month and plenty of information along with market research, while Zacks Premium service offers Zacks rank list and access to a focus list that is built via earnings estimates.

Where these two services differ is in the level of complexity they provide.

The Motley Fool is the better choice for a novice trader who needs to be supported and wants minimal interaction.

On the other hand, Zack’s Investment Research is better suited to advanced traders who want to expand past long-term trades and explore short-term stock strategies.

Given the success of both platforms, purchasing subscriptions in either service can be a profitable decision

Tags:

Tags: