Trading Journals are one of the most important tools in any self-directed investor’s arsenal. Today, we’re reviewing the top trading journals to see who’s number one! Stay tuned for our best trading journal review to find out which journal is on top.

What Is a Trading Journal?

If you’re serious about mastering the market, you should keep a trading journal.

A trading journal is like a diary for your life as an investor, and it’s essential for keeping a clear focus on your results on trading platforms.

Many people keep detailed records of their trade history and trade data in journals.

These commonly used resources are invaluable for traders of all skill and experience levels.

Trading journals are a very personal resource, so they differ greatly in detail.

Some traders simply record their entry/exit positions and trade outcome.

Others take more detailed accounts and build a spreadsheet trading journal that includes detailed information on their perceptions leading up to the trade, post-trade emotions, and more

However, few traders keep their journals in a notebook these days.

It’s clunky, and something as simple as spilling your morning cup of coffee can wipe out years of trade history.

More on Trading Journal Software

There’s a litany of powerful trading journal software available online, and they offer vastly superior capabilities to an old-school notebook.

Modern trading journal software includes sophisticated features to track trades efficiently and painlessly.

They make it so easy to keep a trading journal that there’s no good excuse not to have one.

Some are run through browsers while others are downloadable trading journal software.

We’ll look at some of the best trading journals in this review, so stay tuned.

But first, why should you keep a trading journal?

Why Keep a Trading Journal?

Trading is not a skill that can ever be completely mastered.

It’s a constant learning experience, and the market is always ready to throw you a curveball as soon as you think you have figured it out.

Your best friend in your quest to become a profitable trader is data, and trade journals help you keep track of it.

The more data you have, the greater likelihood you can draw valuable insights from the information.

Why It’s Important to Track Performance Data

One of the most valuable sources of data you have is your own first-hand trading experiences.

Unfortunately, it’s hard to keep track of your thoughts and insights without keeping a detailed record.

Trading journals automatically organize and store your trading data in a centralized location so you can thoroughly analyze your results and improve your performance at a much quicker pace.

This is also exceptionally useful for performing risk analysis.

But what features should you look for to know you’ve spotted a good trading journal?

Here are some journal features to keep an eye out for:

- Can track multiple asset classes and trade types (stocks, options, futures, forex, and cryptocurrency trades, etc.)

- Easy-to-interpret user interface

- Effortlessly tracks trading activity and trade history

- Detailed reports

Build Better Trading Strategies with Valuable Insights

Modern trading journals make it even easier to draw insights from your trading data.

Most platforms can even automatically analyze your results so you can improve even faster.

But which online trading journal is top of its class?

Here are our top three picks for the best trading journal software.

The Best Trading Journal: Overview

Today we’re going to look at some of the top trade journals from across the internet.

Each of these trading journals has a lot to offer, but which ones give you a competitive advantage?

We’re here to find out.

Keep reading for a full breakdown of our top-3 trading journals, so you can decide which has the potential to sharpen your trading edge and help you dominate the financial markets.

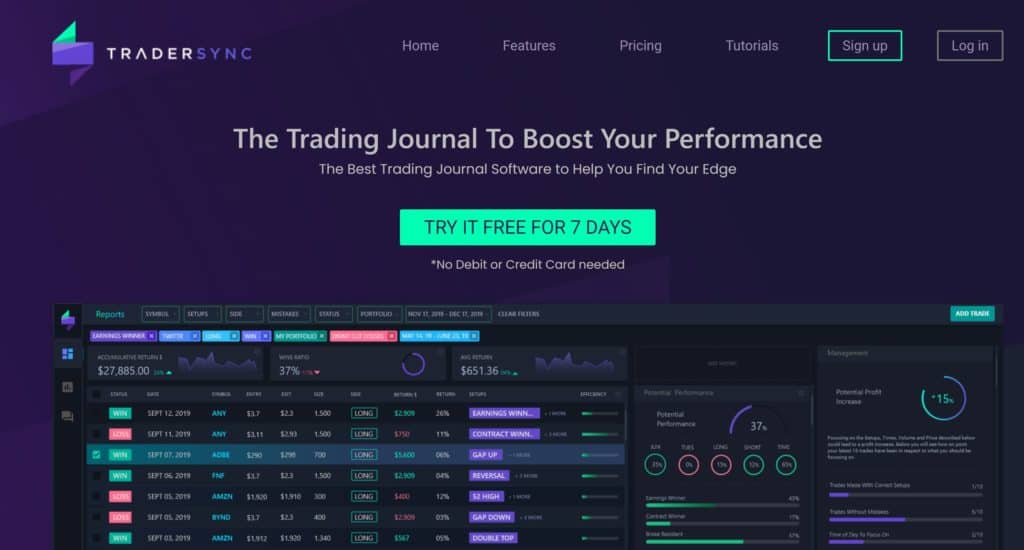

Best Trading Journal: TraderSync Review

TraderSync is a top-tier trader journal with a slew of fantastic applications for traders on the go.

It has a host of sophisticated features to help you track your trading activities and trading performance, including charts, analysis reports, a trade simulator, and more.

Also, the software has an artificial intelligence engine that automatically analyzes your trade data and trade history to find hidden patterns and other insights you might not be aware of otherwise.

TraderSync also has social features that allow you to engage with a wider trading community.

The sharing settings are totally customizable so you can choose what you want to share and who you want to share it with.

>> Read Our Full TraderSync Review Here <<

TraderSync Pros

- Built-in interactive charts with customizable exit targets and stop-loss settings

- Daily journal summary report

- Easy to import trades

- Minute-by-minute intraday charts

- Customizable social sharing

- Specific analytics for every trade

- Can keep track of unlimited trades with Silver Plan

- Built-in notebook for journaling

- Tracks commissions and fees for more accurate profit-loss records

- 10 powerful analysis tools plus drill-down and calendar reports

- AI-powered feedback and patterns

- Trade simulator

- Worldwide market support for stocks, options, futures, and forex traders

- Mobile app available

- Customizable dashboard

- 7-Day free trial period

- Offers a free version with limited functionality

- Enter your trades manually or import them from your broker

TraderSync Cons

- Some features require upgraded memberships

- No refunds

- User interface can be intimidating for beginners (should be fine for the average trader though)

TraderSync has real-time quotes, AI scanning, and more.

Free 7-Day Trial When You Sign Up (No CC Required)

Why We Like TraderSync

TraderSync’s robust selection of features could significantly improve your trading outcomes.

The trading platform analyzes your moves and produces insightful reports so you can get even more out of your trade journal.

Plus, the built-in trade simulator allows you to test new trading strategies without risking any of your hard-earned dollars.

This feature alone could save you untold amounts of money over time.

All and all, we think TraderSync is a great all-around option for just about anyone who wants to closely monitor trading activities.

However, the free version has limited functionality, so you will have to pay for a monthly subscription to use the software to its full potential.

Regardless, TraderSync makes it easy to refine your trading strategy thanks to its arsenal of technical analysis features.

Plus, the AI feedback makes it easy to find useful patterns in your trades.

Access our complete TraderSync review here and learn more about this powerful platform.

Best Trading Journal: Tradervue Review

Tradervue is a comprehensive trading journal software and was one of the very first trading journals to hit the market.

This platform gives you the power to journal, analyze, and share your trades with minimal difficulty.

This journal has a straightforward, utilitarian interface that’s user-friendly and easy to navigate.

However, its simplicity doesn’t come at the cost of functionality.

Tradervue has all the features you expect from a high-quality investing journal, including a social component that lets you link up with friends and publish your trades.

Tradervue has everything you need to effectively track and improve your trading performance.

So it’s a good trading journal for traders of all skill levels.

>> Read Our Full Tradervue Review Here <<

Tradervue Pros

- Auto-import your trades from your broker

- Clean & simple user interface and possibly the best broker importing support

- Price charts and trade notes

- Adds tags to your trades and generate custom reports

- Filter trades by symbol, tag, duration, or date range

- Special features for working with mentors and coaches

- Integrated chart studies

- Running P&L charts

- Multi-currency trade tracking

- Adjustments for commissions and fees

- Automatic reports on liquidity, risk management, and more

- Share your trades with adjustable privacy settings

- Connect with friends and other traders

- Affordably priced

- Free accounts available with limited functionality

- 7-Day free trial for Gold & Silver accounts

Tradervue Cons

- Advanced features require a paid subscription

- No AI-powered insights

Tradervue's dashboard is user-friendly and feature-rich.

Get Started Now for Free!

Why We Like Tradervue

Tradervue is an easy-to-use trading journal with many tracking capabilities.

It has a user-friendly dashboard that makes it easy for beginners and active traders to get started quickly.

Tradervue’s subscription rates are on the lower end of the spectrum, so it’s a good option if you want a trading journal that doesn’t break the bank.

The platform’s sharing features are also compelling.

Tradervue makes it easy to collaborate with a coach or mentor directly through the platform, and you have total control over your sharing settings.

Tradervue offers a unique balance of value, affordability, and functionality.

It’s an excellent option for anyone who’s in the market for a well-balanced trading journal.

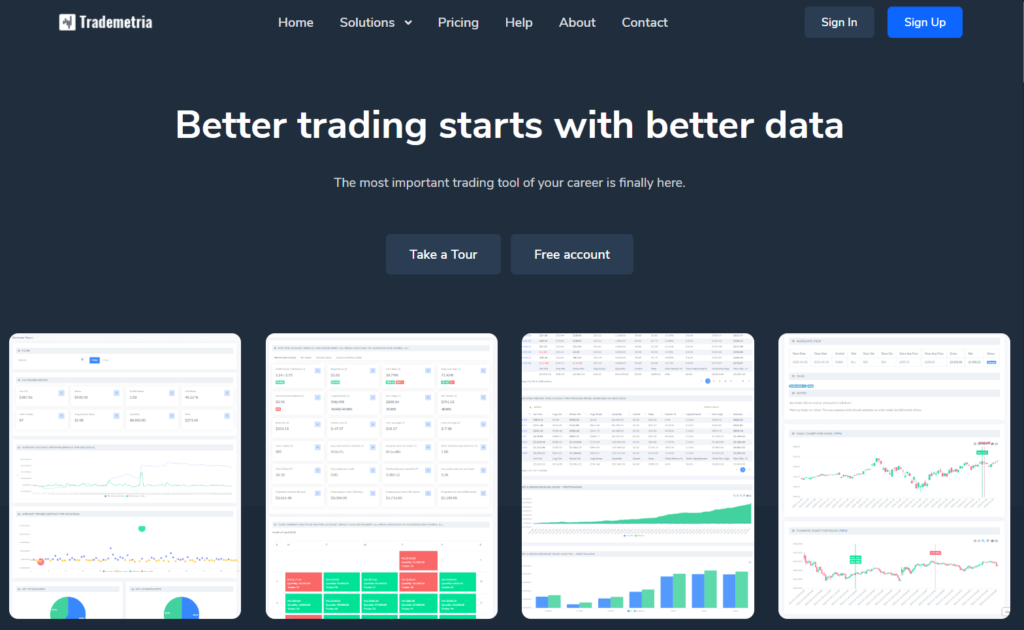

Best Trading Journal: Trademetria Review

Trademetria is an excellent all-around trading journal that also functions as a portfolio tracker and trade analyzer.

This trading journal allows you to monitor multiple metrics on multiple accounts, and it even has a built-in trade simulator so you can test your strategies without risking a dime.

With more than 140 supported brokers, Trademetria easily integrates with most brokers so you can import your trades quickly and efficiently.

Trademetria works on any type of device, and it’s loaded with handy features.

This is a great trading journal for investors of all skill and experience levels.

>> Read Our Full Trademetria Review Here <<

Trademetria Pros

- Supports integration with 140+ brokers or import manually via CSV

- Monitors multiple accounts to easily track trade history and more

- Available data for equities, options, futures, forex, CFDs, and cryptos

- More than 30 built-in trading metrics

- Extensive filter options for trade tracking

- Intuitive charting futures

- Keep organized notes with individual trade and daily journaling

- Search, filter, and share your trading stats

- Automatically display entry and exit points on daily, 1 minute, and 5-minute charts

- Supports charts for 2500 US equities, most foreign equities, FOREX, and most futures

- Auto plots stops and price targets

- Trade simulator with savable settings

- Includes data from 20+ world exchanges

- Customizable account features

- Export your trades for additional analysis

- Affordable monthly rate

- Basic features available for no cost

Trademetria Cons

- No support for OTC stocks

- No refunds once you subscribe

- Delayed quotes

- Order import caps for Free and Basic accounts

Trademetria offers robust capabilities at an affordable rate.

Get Started Now for Free!

Why We Like Trademetria

Trademetria offers a robust selection of features for a very reasonable monthly rate.

It’s a particularly attractive option if you trade with more than one broker because it supports multiple broker integrations.

It might not be the best option for day trading because of its delayed quotes, but Trademetria has everything most traders need to succeed.

If you’re looking for an affordable trading journal with a robust feature set, Trademetria checks many of the most important boxes.

You can use Trademetria’s tools to refine your trading strategy, conduct better trade analysis, and keep more organized notes for your trades.

Plus, the free version of Trademetria also has a strong feature set, so you can get a lot out of this trading tool without signing up for a premium account.

Trademetria has some limits, but it’s a great all-around option for many traders.

Best Day Trading Journal

TraderSync (Read Our Full Review)

Tradersync has a fast-paced trading interface with support for intraday charting and real-time quotes.

It also allows you to run your positions through a number of AI-powered screens and metrics so you can make fast trading decisions on the go.

The real-time price data makes TraderSync a natural choice for day traders.

It also makes it easy to monitor your positions and track investor sentiment on the fly.

TraderSync has all the features you need for effective intraday trading, and it easily takes the title for best day trading journal on our list.

>> Signup for a free 7-day trial of TraderSync now <<

Best Trading Journal for Beginners

Tradervue (Read Our Full Review)

Tradervue is an excellent option for entry-level traders.

It has a very user-friendly dashboard that makes it easy to connect with friends and share your trading status.

Beginner traders will also appreciate Tradervue’s affordable price tag.

You can get used to the platform using the free version, and the fully loaded gold tier costs just $49 per month.

If you’re looking to get into a trading journal for the first time, Tradervue should be your first stop.

It’s extremely affordable and easy to use, and it has all the features you would expect out of a premium trading journal.

>> Signup for a free 7-day trial of Tradervue now <<

Trading Journal with the Most Features

TraderSync (Read Our Full Review)

TraderCync takes the cake for the most feature-rich trading journal on our list.

This platform has a veritable arsenal of high-powered features that can help you perfect your trading strategies.

It’s the only option on our top-3 list that allows users to analyze their strategies with a powerful artificial intelligence engine.

This feature allows you to spot trends and make insights you might miss with a regular trading journal.

In addition to its AI superpowers, TraderSync also has extensive social sharing features, a built-in trading simulator, and tick-by-tick intraday charts.

It’s an excellent option for traders who want the most out of their trading journal.

>> Signup for a free 7-day trial of TraderSync now <<

Best Trading Journal on a Budget

Trademetria (Read Our Full Review)

If you’re looking for an affordable entrance into the trading journal market, you can’t go wrong with Trademetria.

This platform has a solid set of features and the fully loaded premium subscription costs just $29.95 per month.

Trademetria also offers a free version, but it has limited functionality.

You can also go for the mid-tier basic plan that costs $19.95 per month, although you will have to deal with caps on order imports and broker integrations.

With costs that low, Trademetria is a great option for newer traders who want to try out a trading journal for the first time.

Despite its affordability, Trademetria has extensive capabilities, and it can significantly benefit your trading outcome.

Its capabilities are more than sufficient for most types of traders.

>> Signup for Trademetria for free now <<

Conclusion: What Is the Best Trading Journal?

Trading journals can help traders take a much more analytical approach to the market.

You can garner valuable insights by tracking and analyzing your trades in an orderly, organized fashion, and trading journals are the perfect tool for the task.

Many of the best trading journals also have other trading tools built directly into their platforms, including stock screeners, trade simulators, and chart analysis.

With such vast capabilities, these trading journals could quickly become the go-to trading tool in your arsenal.

These tools can help you refine your trading strategies to a finely honed edge and significantly improve your trade outcomes.

Improve Trade Analysis Today

If you’re ready to get serious about trading, getting a quality trading journal should be the first item on your to-do list.

They’re essential resources for tackling the market in an organized, strategic fashion.

Our picks for the best trading journals are great places to start, but they represent just a small part of a vast market niche.

Check out our reviews on these trading journals to learn more about these high-quality options.

Tags:

Tags: