Payment gateways such as Stripe or Paypal very rarely face downtime. This can result from various factors such as using an expired credit card, insufficient funds in the account, a gateway misconfiguration, any type of fraud activity, and many more.

But no matter why a payment gateway crashes, it can cause many problems for the users. It can cause a loss in the overall revenue and increase churn.

It is no surprise that whenever a gateway is down, it causes a lot of stress for the users and the company. However, in this article, we will be discussing a few ideas through which you can protect yourself during this downtime.

What Is a Payment Gateway

Before we jump into methods to protect yourself against outages, many of you might not clearly know what a payment gateway is and how it works. We will take a look into these first.

In simplest terms, a payment gateway is an online digital payment service. It reads payment cards such as credit cards and sends that card’s information to the merchant bank.

The bank then processes the information and confirms any valid transaction made through that card.

Most people use a payment gateway compared to traditional paper money payment because it is safe and secure. The card user’s personal information is encrypted while the payment is processed.

How it Works

Knowing how payment gateways work will give you an idea of what makes these gateways go down and how you can work around it to protect yourself in case such incidents occur.

The core concept of a payment gateway is fairly simple. There are two major roles a payment gateway plays while any transaction occurs. The first and obvious is to confirm the transaction process, and the second is to encrypt all personal data.

This increases the security of all card users, and hackers cannot attack the transaction process to bypass money.

When you buy anything online, you will see a box where you need to put your credit card details. That is the payment gateway. The gateway encrypts all the data you provide and sends them to the financial institute, the bank.

The bank then confirms all the data, and when the data is approved, the payment gateway finalizes the transaction. A simple yet secure method of transaction.

Ways to Prevent Downtime when Your Gateway Crashes

As mentioned before, there could be a variety of reasons which could cause the gateway to crash. But it is up to you to know what you need to do to overcome these problems and protect your information and transaction process.

Here is a list of things that would ensure you are safe even when there is a payment gateway outage.

1. Have Multiple Gateways

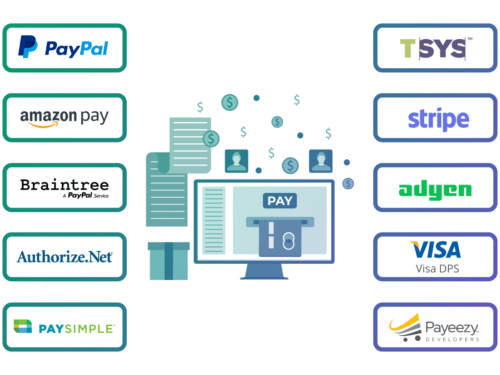

Companies can provide multiple gateways and payment opportunities to enhance your business. Having more than one gateway is always a plus point. Check out finxp.com to learn more about the services such companies offer.

Not only does it give you an extra layer of security, but it also increases your option and method of payment as different payment gateways are connected to different banks.

For example, your go to payment gateway is Stripe. However, it is facing downtime and cannot be used to conduct any transaction. If you only used Stripe, your transactions would halt until the gateway gets fixed.

However, if you had another payment gateway such as PayPal, you could have easily switched to it and completed your transaction. So not only does it opens up more opportunity, but it also saves you the trouble of waiting a long period.

2. Have Prior Notice

Most financial institutions or payment gateway companies themselves notify the users through mail or advertisement that their gateway faces an outage. Although this is not necessarily a direct way to protect yourself, being aware of the whole situation will save you from a lot of trouble.

For example, if you did not know about the outage and conducted any transaction, then you would see a transaction error, where your money would have been deducted, but the transaction would not be finalized.

On the other hand, during these outages, the encryptions are at their weakest, which makes it easy for hackers to crack the encryption and steal your personal data.

So regularly check your mail for updates regarding your preferred payment gateway, and avoid using it if the company has notified you about upcoming outages.

3. Failed Payment Recovery

This is more of recovery than protection, but it eradicated any issues you may have faced while conducting any transaction during the outage.

An outage causes a loss of revenue, especially if the transaction is made by a large company instead of an individual. A lot of money can be lost without a trace if transactions are made amidst an outage.

This is where failed payment recovery comes to help. This uses many different methods such as Retrying failed payments, Sending the customer emails, and allowing the customer to modify payment methods to recover any failed transactions.

Out of these methods, retrying for failed payments is the most common method to recover lost revenue.

But suppose the transaction is already made on one end without the process being finalized. In that case, the failed payment recovery method will email the customers and the financial institution to notify the issue.

Final Thoughts: Protect Your Business if the Payment Gateway Crashes

As modern life is getting increasingly digitized, so has the fundamental aspect of transactions. It makes trade or buying and selling procedures much easier, and both parties involved are safe because the transaction information is secured through strict encryption.

However, technological disturbance is not unheard of. As a result, payment gateway outages can happen now and then. But if you follow the methods listed above, you can be assured that you and your money will be safe during any outage.

Tags:

Tags: