There is no one right answer on when to sell a stock. However, a general rule is that you should never sell a stock simply because the price went up or down.

Whatever the reason to sell your stock, smart investors will never make these decisions on a knee-jerk reaction or other emotions.

So when is the right time to sell a stock? Some reasons to sell are:

- The stock price is increasing rapidly

- The company has bad press

- The company is being acquired

- Taking advantage of gains or you need immediate cash

- Considerations regarding taxes

Sometimes, knowing when to buy a stock is much easier than selling. This is because buying stock represents value gained, whereas selling stock too early represents a loss of value.

While it might be intimidating for beginner investors, selling your stock is an important part of personal finance. The right mindset makes knowing when to sell much easier and positions you to make better trades in the future.

Think rationally about what your goals are with this specific stock and why you purchased it in the first place. If these values no longer hold true and you see a better opportunity, it could be time to sell.

The main goal of investing is to maximize profits and minimize losses. The stock market changes daily, but there are key principles that will always hold true.

Ideally, you want to limit your losses to 7%–8% and in a healthy market, taking at least a partial profit at 20%–25% is recommended, unless you are following the 8-Week hold rule.

Navigating the complexities of the stock market can be difficult to manage, so we are breaking down when you should sell a stock.

When to Sell a Stock: What is the 8-Week Hold Rule?

The 8-week hold rule is an investment strategy that many investors use to identify potential market-winning stocks — ones with real potential for growth. The main benefit of this strategy is that it gives you adequate time to measure stock performance.

When a stock gains upwards of 20% within one to three weeks of purchase, you should hold it for eight weeks.

The reason for holding a stock is because if the stock’s price trends upwards this quickly, it has the potential to become a market-winning stock, rising 100% or more.

Stocks only move based on their institutional demand. So for a stock to move with this power, it must have great demand and be unlikely to fall short due to selling pressures.

This is where the old saying “the real money is made when you hold comes into play,” because it’s actually made when you can properly identify if you have purchased an 8-week hold stock.

Here are a few key markers to help identify if the stock should be held under this rule:

- The stock should be coming out of a 1st or 2nd base stage

- Later base stages are riskier

- Present with market-leading fundamentals

- Should perform well relative to other groups

- A top-rated stock within said group

- The company has solid earnings, sales, and ROE

- Institutional sponsorship

- Owned by top-performing funds

- A rise in the number of funds owning shares

When to Sell a Stock: Top Strategies to Sell Stocks at the Right Time

Now that we have established when to hold a stock, you may be wondering when the “right time,” to sell a stock is. Knowing when to time your sale is important because it means the difference between profit or loss.

The truth is there isn’t a single answer — at the end of the day — it is about maximizing your investment and what is for the best of your portfolio. Sometimes, you may want to hold a little bit longer or sell and move to another stock, and this is up to you.

When selling a stock, you have the option for “orders” to sell. There are four different types of orders an investor may use:

- Market Order

- Limit Order

- Stop-Loss Order

- Stop-Limit Order

Market Order

Market orders are for investors who want to buy or sell a stock at the best available price ASAP.

The risk of this order is your stock could sell at any time with no restrictions. You should use this order if you want to sell the stock at any price.

The market order is very generic, and prices can fluctuate in a matter of seconds. This option is not necessarily the best one, especially if you have specific parameters you would like to sell the stock under.

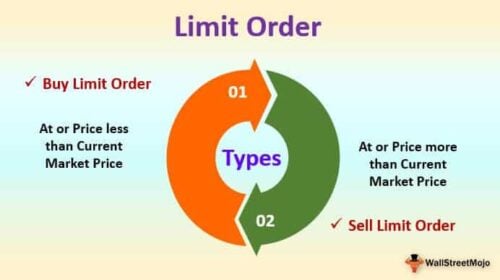

Limit Order

A limit order allows you to stipulate a price you want to sell the stock at. Investors who are fine with holding the stock until it reaches their desired sale price should utilize this order.

How it works is the investor sets a “limit” or price they want the stock to sell for. The order will only trigger once this stock reaches the set price, or better.

The risk of using this order is that it may take a long time to reach the set price.

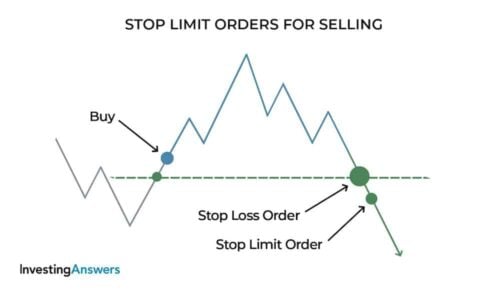

Stop-Loss Order

Selling a stock at a loss may require a “stop-loss order.” This allows an investor to minimize their losses if a stock price begins to plummet. If the stock falls below a certain price, it would trigger the sale of your stock.

Stop-loss orders are a solid exit strategy from a poorly performing stock, but it should be used with caution.

Investors need to be strategic with the price they set for a stop-loss order because a temporary dip in the market may trigger a sale, even if they do not want to sell.

As stated earlier, it is ideal to minimize losses to around 8%. You have the option to set your stop-loss order to a certain loss percentage (5%, 10%, 20%, etc.).

The risk with this option is that you may end up selling below the market price and still lose money. However, if a company’s outlook is bleak or they are going through major changes, it still may be in your best interest to minimize your loss.

Stop-Limit Order

The stop-limit order is exactly what you may think it is: a combination of the stop-loss and limit orders. An investor sets their terms for when to sell if a stock drops, but they’ll only sell the stock for their minimum price.

For example, you have a stock that is $50. If the stop price is $49 and the limit price is $45, the order will be executed as a limit price if the stock’s bid drops to $49.

This order is still not without its risks. If the price of the stop drops too quickly, which can happen in a volatile market, your stock may not sell at all.

Orders are not the only strategies an investor may employ to sell their stock. There are a few other investment strategies you may want to utilize:

Scale in/Scale out

Scaling out is only done when a stock is profitable. If momentum on a stock is slowing down, scaling out allows an investor to sell off portions of their stock share as the price increases.

Scaling out allows you to protect your investment by setting multiple profit targets for your one purchase and still make money.

You will have earned more if you hold onto the entire investment, but scaling out protects the profit that you have.

Scaling in affects how an investor buys shares. You set your target price and purchase more volumes of shares as the stock price drops.

Investors risk the chance of purchasing a losing stock if it never returns to the target price.

It’s important to remember scaling in will come more fees because you are making numerous purchases instead of one large one.

Scaling in lowers the average purchase price of stocks. If an investor wants 1,000 shares, they may purchase different amounts of a share at different price points.

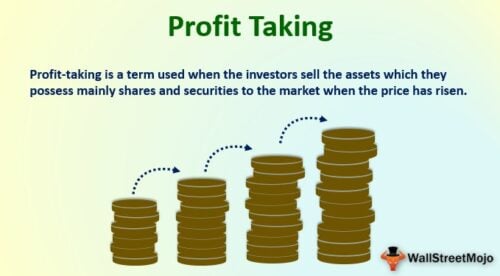

Profit-Taking

Profit-taking is when an investor will sell after their gains have significantly risen to lock in their profit.

While it will benefit an individual investor, it could potentially hurt others if the sale triggers a dip in the share price without notice.

The long-term direction of the stock is unlikely to change if the sale is triggered by a one-time event such as a quarterly profit report.

Long-term weaknesses can come into play if there are significant concerns about the company or the overall market.

Knowledgeable investors will keep the capital gains tax in mind on their investments. Once your stock reaches a 23% gain, you may consider selling.

The 3% will cover the 15% capital gains tax, and you will still be left with a 20% return on investment.

So, What Is the Best Timing to Sell Stocks?

Every investor has different goals, so there isn’t one right answer on when to sell a stock. There are plenty of good reasons to sell, so it really just depends on what kind of investor you want to be.

Typically, traders looking to make short-term profits find it beneficial to take advantage of price fluctuations in the market with little focus on the fundamentals.

Investors looking to maximize their long-term gains are better off looking at the stock fundamentals and overall outlook.

Long-term projections of a stock will matter more than day-to-day fluctuations in the market.

Your decision to trade a share should reflect the best possible option for your financial investment.

The same goes for when you decide to invest. At the end of the day, you should be doing what is best for your personal portfolio.

When considering selling a stock, ask yourself why you bought it in the first place. Are those reasons still valid? You can also look at your portfolio as a whole.

Trading experts recommend that you reevaluate your holdings once a year to determine if you have the right mix of financial assets.

Tags:

Tags: