Choosing the right stock screener can make or break your investing strategy.

With thousands of tickers trading every day, it’s impossible to track them all manually, that’s where a smart, data-driven screener comes in.

With so many stock screeners online, however, choosing the best one for your trading style can be a difficult task.

In this article, we reviewed the top stock screening tools on the market, evaluating each for speed, data accuracy, customization, integrations, and overall value so you’ll know exactly how to choose the best stock screener for your trading goals

What Is a Stock Screener?

A stock screener is an online tool or software that helps traders and investors filter thousands of stocks down to a manageable shortlist using specific criteria, like price, volume, market cap, dividend yield, or technical indicators.

Instead of scrolling endlessly through ticker symbols, a screener lets you set custom filters and instantly see which stocks match your exact strategy.

Most stock screeners come with built-in data feeds, customizable dashboards, and real-time updates that you can use to create a system that works best for you.

Several also integrate charts, news alerts, or backtesting tools so you can analyze performance trends before making a move.

Some even use AI-powered insights or sentiment tracking to surface opportunities that traditional filters might miss.

People use stock screeners because they save time, reduce emotional decision-making, and uncover hidden opportunities that meet their trading goals.

Whether you’re a beginner trying to find undervalued stocks or a day trader scanning for high-momentum plays, a reliable screener turns endless market noise into clear, actionable data, helping you focus on what really matters: making smarter investment decisions.

What to Look for in the Best Stock Screener

If scanners are a new concept, you might not know what to look for when shopping around.

Here’s what you should search for when shopping for a stock screener.

Price

Stock screeners come in all shapes, sizes, and levels of sophistication.

The most sophisticated screeners can cost thousands of dollars, but basic free stock screeners are also available, though many investors opt to pay for a premium stock screener for the added features.

You shouldn’t necessarily run out and buy the most expensive stock screener you can find, especially if you are just starting and don’t know how to use certain features like chart drawing tools, hedge fund portfolio trackers, complex data analysis, etc.

Generally, you want to look for screeners that fit your needs and have the tools to boost your investment strategy.

Customization

Customizability is a big deal for serious traders.

If you’re a highly focused technical analysis trader, then you need a fully adjustable screener that allows you to input multiple filters to track pre-market data, fundamental and technical data, general stock data, and so on.

Some stock screeners only accept preset screens.

This isn’t a major problem for some stock traders, but it could be a dealbreaker for data-focused fundamental and technical traders looking to use their own technical screening criteria.

Make sure the stock screener you choose has capabilities that match your trading style.

Data Feeds

Every stock screener doesn’t use live, real-time data.

Typically, live-data screening tools cost more than delayed data options.

The screener companies have to pay to access real-time quotes, and the added cost gets passed along to the customer in most cases.

Long-term investors and swing traders might be okay with delayed data in return for the savings, but most day traders and other fast-paced investors will want stock screeners with live data.

If you have a fast-paced investing style, you will probably want to choose a screener with real-time data feeds.

The 5 Best Stock Screeners for 2025

We reviewed the best stock screeners to help you narrow your search.

These are all excellent tools, but they each have their own unique features and benefits that make them stand out as exceptional in comparison with other options on today’s market!

Keep reading for a deep dive into the best stock screeners.

Best Stock Screener: Stock Rover

Stock Rover is the first stock screener on our list that has a free component. However, it has plenty of advanced features, and its premium upgrades make it a worthy tool for any serious trader.

Stock Rover offers everything you would expect from a high-quality screener, and it’s a little more user-friendly and has a less intimidating interface than some of the other options on our list.

Stock Rover’s free stock screener allows you to get a feel for the platform and access some basic features, but you’ll need to upgrade to premium to unlock its full potential.

Premium subscriptions come in three tiers, each with a different set of features and prices.

>> Get started with Stock Rover now. It’s free to join! <<

Stock Rover: Best Features

Stock Rover has an impressive lineup of features, but these are the most notable benefits:

Free Stock Screener and Premium Trial

You can sign up for Stock Rover for free and get complimentary access to premium features for a full two weeks when you join.Best of all, you don’t need a credit card to register.

Simply sign up with your email and you’ll automatically have access to premium.

Once the trial ends, Stock Rover will automatically downgrade you to the free version, and you’ll have to subscribe to restore your access.

It’s all free, so sign up here.

Stock Rover Built-In Research Reports

Stock Rover has detailed research reports built directly into the platform.

Reports are available for each of the 7,000+ stocks in Stock Rover’s database, and the reports feature independent investment information from qualified pros.

Each individual equity report includes a detailed evaluation of a wide array of investing factors and more than eight pages of in-depth analysis.

>> Signup for a No-Obligation Free Trial Now (No CC Needed!) <<

Stock Rover Pros

- Partial access is available for free

- Complimentary 14-day premium trial with no billing information required

- Stock ratings are great for beginners that want to start screening stocks with confidence

- Built-in research reports

- Advanced portfolio analytics with available brokerage integration

- Extensive charting capabilities and dynamic tables

- Portfolio analysis

- Insight panel with in-depth financials

- User-friendly interface makes it easy to chart patterns

- Up to 10+ years of historical data

- Sophisticated metrics available

- Database includes mutual funds, ETFs, and stocks

- “Investor Warning” feature alerts users to potentially risky stocks

- Correlation analysis

- Future dividend income projections

- Portfolio Rebalancing shows you how to properly diversify your holdings

- Wide variety of affordable pricing options

Stock Rover Cons

- No social component

- No trader education courses

Who Is Stock Rover Best For?

Stock Rover is a contender for the best stock screener for these applications:

Casual Trading

Stock Rover is user-friendly and affordable.

The platform offers many of the same features as more advanced stock screeners, but it has a less intimidating user interface than many of its competitors.

Better yet, it has several affordable pricing options, so you only have to pay for what you need.

Fundamental Analysis

Many of Stock Rover’s most notable features focus on good ol’ fashioned fundamentals.

Stock Rover has built-in research reports and a massive arsenal of metrics to help you zero in on the best trades without getting weighed down in a mire of endless technical analysis minutia.

Read our full Stock Rover review for more info.

>> Try Stock Rover Free for 14 Days <<

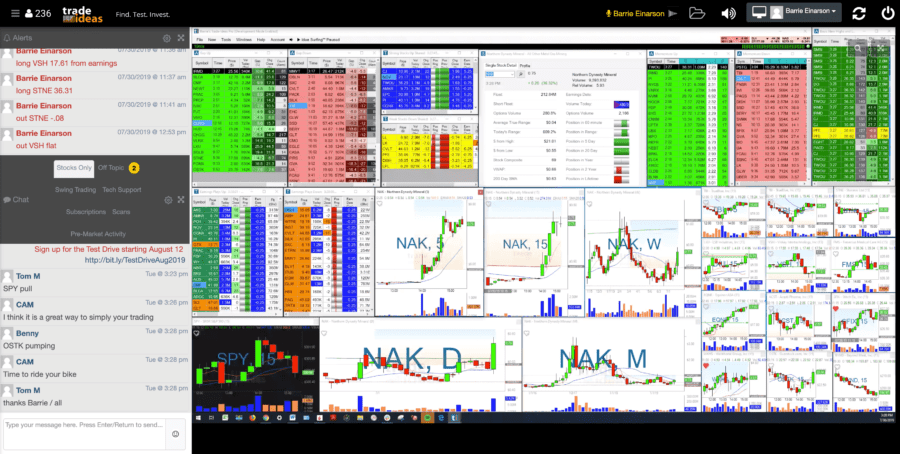

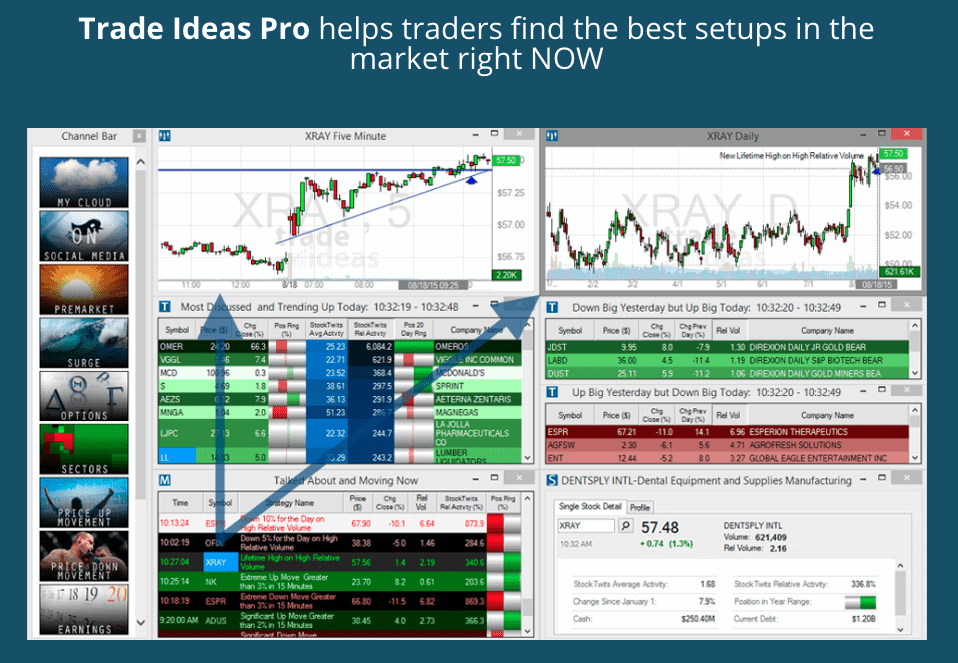

Best Stock Screener: Trade Ideas

Trade Ideas is probably the most sophisticated, powerhouse stock screening tool on our list.

The screener boasts an impressive array of premium features, including AI-powered stock screens, pre-market scanning capabilities, brokerage account integrations, real-time data, and more.

It’s the priciest option on our list, but its capabilities more than justify the costs.

You can use Trade Ideas to set custom screens using a wide array of fundamental and technical criteria.

Trade Ideas’ built-in stock charts also make it easy to conduct detailed technical analysis through the platform, so there’s no need to switch through multiple apps.

>> Get Started with Trade Ideas Now <<

Best Trade Ideas Features

Here are some of the top reasons to sign up for Trade Ideas:

AI Holly with IBKR Integration

Trade Ideas’ AI trading capabilities put this stock screener in a category all its own. This powerful system can automatically spot trade opportunities and execute them.

Unfortunately, fully automatic AI Holly trading only integrates with Interactive Brokers at the moment.

Automatic trading is only available with Trade Ideas premium so you can’t use it with a basic account either.

However, automatic trading can be a gamechanger if you’re willing to set it up.

OddsMaker Backtesting and Simulated Trading

Serious fundamental and technical traders put a lot of work into finding the perfect trading formula.

OddsMaker backtesting uses a vast cache of historical market data and shows you what kind of results your chosen strategy produced in the past.

There’s no guarantee that history will repeat itself, and what worked in the past might not work in today’s market.

But this is a good place to start.

>> Join Trade Ideas to Take Advantage of These Powerful Trading Tools Now <<

Trade Ideas Pros

- AI-powered automatic stock picking with interactive Brokers

- Brokerage account integration with several popular brokers

- Make trades directly through the platform with one click

- Backtest your trading strategies with OddsMaker

- Built-in chat feature

- Data centers are located near major stock exchanges for faster updates

- Screen of a company’s financial indicators

- Fast and accurate integrated newsfeed

- Multi-variant, color-assisted sorting (patent pending)

- Integrated paper trading

- Feature-rich chart windows

- Dozens of pre-set “Channel Bar” screens

- Sophisticated fundamental and technical analysis tools

- Alerts and notifications

- Rich selection of educational resources and classes

Trade Ideas Cons

- Could be cost-prohibitive for smaller budgets

- Steeper learning curve

Who Is Trade Ideas Best For?

Trade Ideas is a great fit for these applications:

Active Swing Trading and Day Trading

Trade Ideas AI-powered scans and trade suggestions make it easy to identify fast-moving opportunities in real-time.

It automatically scans trading volume, technical indicators, and more to find the best momentum plays quickly and efficiently; perfect for fast-paced day trading.

AI-Powered Automatic Trading

If you want to put your portfolio on autopilot, Trade Ideas is one of the only truly autonomous tools on the market.

Trade Ideas’ sophisticated AI will buy and sell stocks using the latest technical data to identify opportunities with a high probability of success.

So far, “AI Holly” has racked up an impressive track record of winning trades, and it’s hard to pass up on its automated trading feature.

Read our full Trade Ideas review to see if it’s the best stock screener for you.

>> Sign up for Trade Ideas now and start trading with Holly AI <<

Best Stock Screener: BlackBox Stocks

BlackBox Stocks is a sophisticated stock screener and trading platform with a rich selection of features.

It’s suitable for advanced users, but beginners also report success with the platform.

This stock screener has all the features you would expect from a top-tier scanner, including automatic market movers, real-time price quotes, volume ratio scanners, and much more.

It has a robust educational program for new traders and community features, including a members chat room.

The platform also has a sophisticated options screener built-in so it’s a great choice for options traders.

Best BlackBox Features

BlackBox Stocks has a few notable features worth mentioning:

Specialized Options Software

BlackBox Stocks’ options screener adds a valuable element to the usual stock screener functions.

This unique tool makes it easy to find suitable options trades just as easily as regular stocks.

It’s a no-brainer for options traders, and it has the potential to make your trading routine much more efficient.

Community Features

As is the case with many things in life, trading is a lot easier with a little help from a few friends.

BlackBox Stocks community features make it easy to network and share insights with other traders.

The platform has an integrated social media component that allows you to follow trending stocks and members of the BlackBox Stocks community.

>> Build Your All-Star Trading Team with Blackbox Stocks <<

BlackBox Pros

- Powerful, built-in options screener

- Excellent stock screener with advanced functionality

- Automatically tracks and alerts you to developing trade opportunities

- Pre-market scanner finds trade opportunities hours before the opening bell

- Integrated social media and community functions

- Includes BlackBox Boot Camp trader education course

- Real-time quotes and price action

- Proprietary volatility indicator

- Real-time explosive gains watch lists

- Integrated stock charts and screening options

- Alerts and notifications

- Built-in StockTwits feed

- Excellent tools for day traders and options traders

BlackBox Cons

- No brokerage integration or in-platform trading

- Maybe cost-prohibitive for small-budget traders

>> Join BlackBox Stocks Now and Start Screening! <<

Who Is BlackBox Best For?

BlackBox Stocks might be a good option for you if you fit into one of these categories:

Day Trading

Day trading stocks is a lot more effective when investors work in groups.

BlackBox Stocks makes it easy to follow other day traders with its integrated social follow features.

Options

BlackBox Stocks’ unique options scanner makes this stock screener a natural fit for options traders.

It has intuitive features that will save you hours of research time, and it can help you find the best contracts for your trading strategy.

Also, you can program it to scan for exactly what you want.

Read our full BlackBox Stocks review for more info.

>> Click Here to Get Started with BlackBoxStocks <<

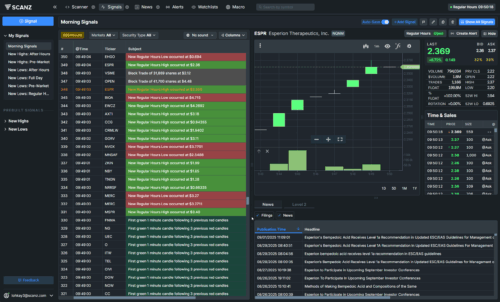

Best Stock Screener: Scanz

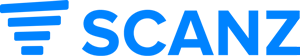

Scanz packs a punch with its recent release of Scanz 3.0 Next Gen, elevating the platform’s features and finally enabling its use through a web browser.

The system is designed with active traders in mind, combining real-time market scanning, news streaming, and level-2 data into a single, lightning-fast platform.

What makes Scanz stand out is how hands-on and customizable it feels.

You can set up scans based on technical indicators, price movements, or volume spikes, and see alerts in real time as opportunities develop. It’s like having a trading assistant that constantly watches the market for you.

Beyond scanning, the platform also integrates tools for news sentiment tracking and breakout monitoring, helping you catch early trends before the crowd does.

Traders love Scanz because it saves them time and sharpens their decision-making.

Whether you’re hunting for high-momentum plays or building a watchlist of breakout candidates, Scanz gives you the kind of speed, flexibility, and insight that serious traders rely on to stay ahead of the market.

>> Start Screening with Scanz Now <<

Scanz Best Features

Here are some of the best features that Scanz offers:

Real-Time Stock Scanning Engine

One of Scanz’s standout features is its real-time stock scanning engine, which is, in my opinion, easily among the fastest in the industry.

What makes it special is the ability to monitor thousands of stocks simultaneously using custom filters like price movements, volume surges, or specific technical setups.

The platform updates in milliseconds, allowing users to spot intraday opportunities before most traders even notice them.

The scanner works seamlessly with both pre-market and after-hours data, ensuring you never miss early breakouts or reversals. What I love most is how flexible it is, you can create personalized scans based on your exact strategy.

Level 2 Market Data

Scanz’s Level 2 Market Data gives you a front-row seat to the real-time order flow happening beneath the surface.

You can instantly see where large bids or asks are stacking up, helping you gauge potential support or resistance levels before the rest of the market reacts.

Plus, the feed updates in milliseconds and displays direct access data from multiple ECNs and exchanges, so you’re not just relying on delayed or fragmented information.

Whether you’re timing an entry for a breakout or spotting when big players start unloading shares, Scanz’s Level 2 gives you that crucial edge.

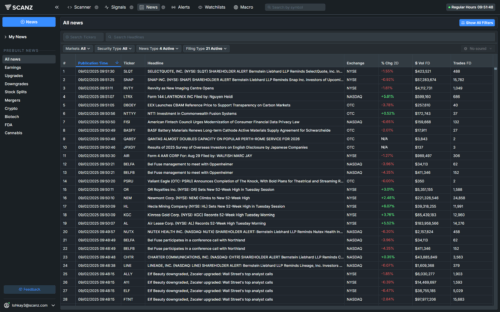

Scanz News Scanner

The Scanz News Scanner is a real-time information powerhouse built for traders who thrive on breaking headlines.

It pulls from hundreds of trusted financial sources, including SEC filings, PR feeds, and top-tier newswires, and filters them down to what actually matters for your watchlist.

You can set keyword alerts to instantly catch catalysts like earnings, FDA approvals, or mergers. It’s incredibly fast, accurate, and keeps you one step ahead of market-moving events.

Scanz Montage

The Scanz Montage acts as your all-in-one command center, bringing together every critical data point in a clean, fully customizable workspace.

You can view live charts, Level 2 quotes, time and sales, and order flow, all in one window.

The layout is sleek, responsive, and designed for quick decision-making.

Whether you’re monitoring a breakout or managing multiple trades, the Montage gives you a professional-grade trading setup without the clutter or lag.

Unlimited Watchlists

With Unlimited Watchlists, Scanz gives you the flexibility to organize and monitor as many stocks as you like, no limits, no restrictions.

You can create custom lists for sectors, trading strategies, or upcoming catalysts, and each list updates in real time.

This feature makes it easy to keep tabs on opportunities across multiple markets while maintaining a clear view of your priorities. It’s a small detail that adds massive efficiency to your daily trading workflow.

Pros

- Fully customizable news scanner

- Powerful stock screener

- Flexible pricing options

- Now allows web-based scanning

- No extra charge for real-time data

- Streaming charts

- Integrates with popular brokers

- Unlimited watchlists

- Scans the Nasdaq, NYSE, and AMEX for data, news, and SEC filings

- Level 2 pricing and 100% real-time data for all supported exchanges

- Vast video tutorials library and trading knowledge base

- Advanced montage data for every ticker

- Customizable breakouts scanner

- 14-Day free trial available

Cons

- No chat, social component

- Cost may feel high for some

>> Take Scanz for a No-Obligation, 14-Day Test Drive Now <<

Who Is Scanz Best For?

Active Day Traders

Scanz was practically built with day traders in mind. Every feature, from its lightning-fast real-time data to its customizable scanners, is geared toward those who rely on quick decisions and precise timing.

The platform’s instant alerts, Level 2 data, and news integrations help traders catch momentum plays the second they start moving.

Since it updates in milliseconds, you can react faster than the broader market, whether you’re buying a morning gapper or shorting a mid-day fade.

The clean layout and easy workflow also mean you’re not wasting time switching screens. If you trade daily and thrive on volatility, Scanz gives you that crucial edge.

Swing Traders

For swing traders, Scanz offers an impressive balance between depth and efficiency.

The real-time scanning tools help you uncover short- to mid-term setups, such as stocks building volume, forming breakouts, or reversing trends, before they hit mainstream radar.

You can also customize scans by price, float, volume, or sector to align perfectly with your trading strategy.

The news and catalyst tracking system ensures you’re not blindsided by after-hours developments that could influence your positions.

In short, Scanz makes it easier to spot swing opportunities early and manage them confidently over several days or weeks.

Momentum and Catalyst Traders

Scanz shines for those who chase momentum or news-driven trades. Its real-time news scanner and rapid alerts let you see breaking stories, earnings beats, merger announcements, FDA approvals, seconds after they hit the wire.

Combine that with the Montage and Level 2 tools, and you get a full picture of how traders are reacting in real time.

This is crucial for understanding when volume is flooding in or fading out.

Momentum trading is all about timing, and Scanz provides the tools to enter at the right moment and exit before the crowd does.

Experienced Investors and Market Analysts

Even though Scanz is tailored for active traders, experienced investors and analysts also find tremendous value here.

The platform’s powerful data visualization, unlimited watchlists, and advanced filtering tools allow for deep market research and tracking of developing trends.

You can analyze liquidity, market depth, and price movements to identify sectors heating up before major breakouts occur.

Whether you’re running your own research desk or simply love staying ahead of market narratives, Scanz helps you cut through noise and focus on what matters, real, actionable data.

Read our full Scanz review for more info on this powerful screening tool.

>> Try Scanz for Free for 14 Days (No CC Required!) <<

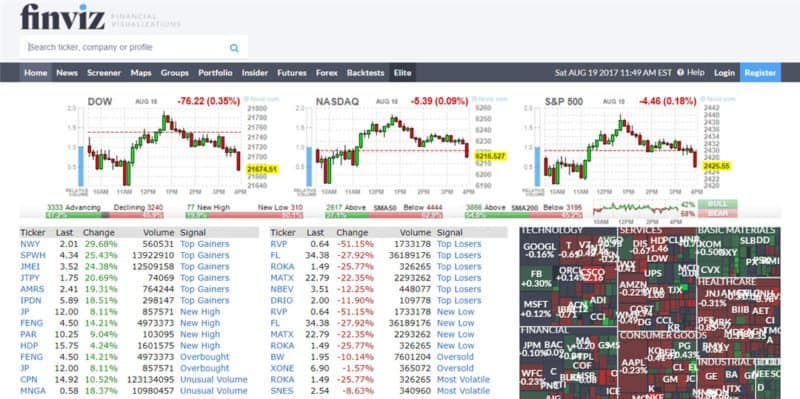

Best Stock Screener: Finviz

Finviz is one of the best free stock screeners on the internet.

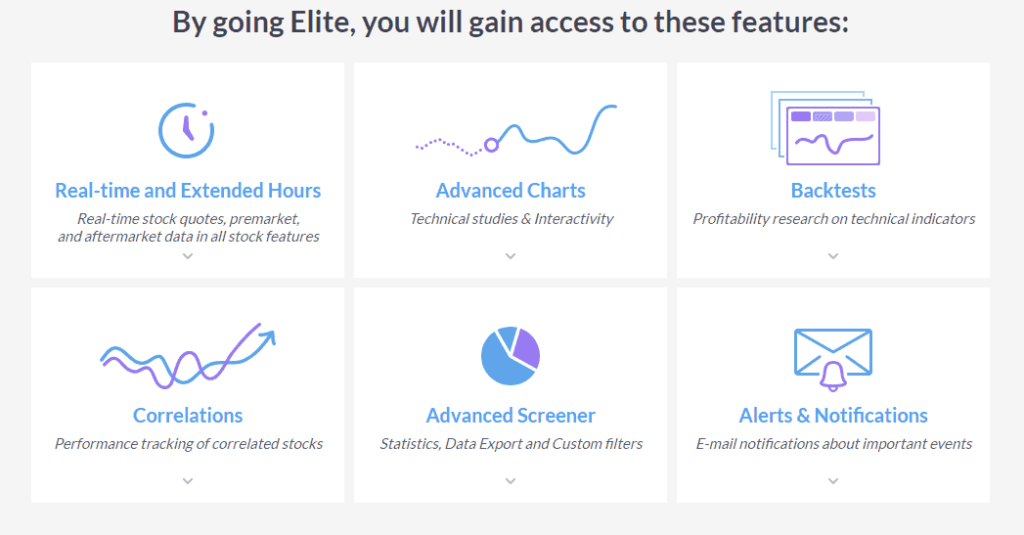

However, the free version has limited features so you should upgrade to Finviz Elite (premium plan) for the most comprehensive trading experience.

If you can’t afford to upgrade to Finviz Elite, you can find great stocks with the free stock screener.

The Finviz stock screener has a ton of common fundamental and technical filters, built-in stock charts, a live news feed, investment analysis, financial analysis, and more.

Unfortunately, Finviz’s free scanner has one notable drawback: it uses delayed market data with no live quotes.

As a result of its day-old quotes, Finviz free is practically useless for day traders.

We think it’s always better to have live pricing data if you can get it, so we generally recommend our readers to go for Finviz Elite.

Finviz Elite is also relatively inexpensive compared to some of the other options on our best stock screener list, so it’s great for beginners and anyone investing on a budget.

>> Try Finviz Elite Risk-Free for 30 Days <<

Finviz Elite Best Features

Here are some of Finviz Elite’s best stock screening features.

Simple Interface

Finviz Elite has a very similar interface to the free version, so it’s a familiar user experience for most investors.

The best stock screeners tend to have very sophisticated dashboards that can be difficult to navigate for less advanced traders, but Finviz has a very straightforward, easy-to-use stock screener with equally powerful capabilities.

Money-Back Guarantee

If you’re asking yourself, “Is Finviz Elite worth it?” you should know that Finviz offers a 30-day satisfaction guarantee on new subscriptions.

Once you upgrade, you have a full month to try out the upgraded features; plenty of time to determine whether it fits your needs.

If you’re not happy, simply contact support and request a refund.

Finviz Pros

- Very user-friendly

- Built-in news feed

- Affordably priced

- 30-day money-back guarantee

- Available free stock screener with limited features

- Detailed financial data and analysis of every stock

- Quotes include insider trading data

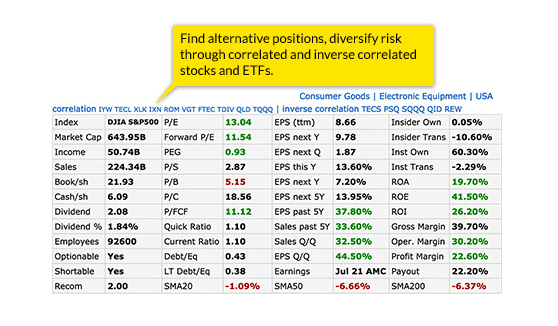

- Track the performance of correlating stocks

- Backtest technical indicators and trade strategies

- Save up to 100 custom screens

- Ad-free experience

- Screen for stocks, ETFs, futures, forex, crypto, and more.

- Real-time stock quotes with premarket and aftermarket scanning

- Email alerts for price moves, insider trades, rating changes, and news

- Track financial statements going back 8 years

- Export screeners for use in external applications

Finviz Cons

- No data on OTC or AMEX stocks

- No social component

>> Take Your Trades to the Next Level with Finviz Elite <<

Who Is Finviz Best For?

Finviz Elite is a great stock screener for these investing styles:

Beginners

Finviz has one of the gentlest learning curves of any of the options on our best stock screener list.

It’s easy to use, and you can practice with the free version for as long as you want without paying a dime.

Once you master the screener, you can upgrade to Finviz Elite for even more functionality.

It’s the perfect way to acclimate yourself to the stock market quickly and efficiently.

Fundamental Investing

Finviz seems to prioritize fundamental trading and analysis, so it’s a great option if you use these types of metrics for your investment portfolio.

The Finviz quote layout lists all the most important fundamental factors for every ticker so you can quickly find the best stock picks for your investing style.

Read our full Finviz review for more info.

>> Start Screening with Finviz Elite Now <<

Featured Stock Scanners by Category

Stock screeners make it a lot easier to find high-quality stocks for your investment portfolio.

However, everyone has different personal finance needs, so we wanted to organize our best stock screeners list into a few popular categories. Here they are:

Best Free Stock Screener

Finviz is the best free stock screener on our list.

The free version has more functionality than any comparable free scanners on the market.

Best Day Trading Stock Screener

It has a robust stock screener, an arsenal of built-in financial tools, and a cutting-edge news scanner that can scan financial data from the NYSE, NASDAQ, and AMEX.

It even has an add-on for OTC stocks.

Plus, you get standard access to the Level 2 order book for every exchange too when you sign up, in addition to real-time quotes.

Best AI Stock Screener

If you want fully automated AI trading, consider Trade Ideas.

You can connect directly to Trade Ideas’ Holly AI with an Interactive Brokers Brokerage Plus account, and Trade Ideas will trade stocks in your portfolio based on Holly’s analysis.

Best Stock Screener Review: Closing Thoughts

Stock screeners are an essential part of any trader’s tool chest.

They can lead you to high-potential stock picks that you may have never come across otherwise.

If you want more options, Zacks Stock Screener, Yahoo Finance, and Benzinga Pros’ Stock Screener are other solid all-arounders.

Stock screeners can find stocks based on your investment style so you take an independent approach to the market.

It’s the surest way to get the most out of the stock market, and our best stock screener list is chock full of excellent options.

Remember to click the links to read out our full-length reviews for each screener.

Good luck and happy screening!

Tags:

Tags: