One way to play the fluctuations in the stock market without risking all your money is to short sell stocks.

This guide will give you a breakdown and tips on how to short stocks on Webull and help you learn the risks associated with the process.

Webull is an online stock trading platform that offers a wide variety of stocks via its free mobile app and website.

Webull is an excellent trading app for beginnings and experienced investors alike. It has zero-fee trading, and you’ll even get a free stock (valued up to $1600) just for signing up!

Can You Short Stocks on Webull?

The answer is yes. You can most certainly short a stock on Webull.

Unlike many online trading platforms that only let you quasi-short a stock, like Robinhood, you can make direct short sales on Webull.

Short selling on Webull is a trading strategy that provides an excellent opportunity for traders to make money.

Because shorting a stock is typically a moderately advanced investment technique, many expert traders gravitate toward this platform.

So now that we’ve answered that short selling on Webull is possible, we’ll explain what it is in detail and how to do it.

What’s Shorting a Stock/Short Selling?

Short selling is the opposite of buying.

We know this trading strategy might seem strange initially, but stay with us; it’ll all make sense soon.

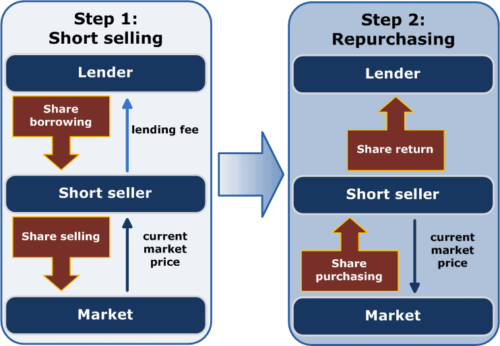

When you short stocks, you borrow the shares from an investor and sell them in the hopes that they’ll go down in value so you can repurchase them for less than what you sold them for earlier.

Your profit would be the difference between what you initially sold the stock for and the stock’s price when you buy it back.

Of course, the trade’s profit potential will depend on what the stock does, but a common goal is to buy back the shares at a lower price.

How Traders Turn a Profit Short Selling a Stock

A trader who short-sells a stock is borrowing that asset from the broker for an agreed-upon period.

And these traders are known as… you guessed it, short-sellers.

The investor then sells the stock at its current price and waits for this value to drop before repurchasing it at the lower price, earning profit in the difference.

This process has become very popular with traders during recent economic downturns, as it’s a way to make money during these periods of low prices.

The market for shorting stocks has become even more popular in the past few years, and now some brokers specialize solely in this process.

Since you can sell off shares without having to buy them first, traders can earn big profits from buying when they think the price will go down and selling when they think it’ll go up.

Though keep in mind, there are risks involved, and you need to put in a lot of analysis to ensure that you aren’t buying back the stock at a higher price than it was loaned to you.

Let’s run a quick scenario on shorting a stock.

Suppose a trader believes XYZ stock will drop in price in the next two months despite its current price of $100.

Therefore, the trader borrows 100 XYZ shares from a broker and sells them for $10,000 to another investor.

XYZ’s 100 shares have now been “shorted” by the trader.

The short sale occurred because the trader borrowed the shares from the broker, which wasn’t always possible if other traders were also heavily shorting the stock, thus limiting the number of shares that could be borrowed and sold.

Within a month, XYZ company reported poor financial results below market expectations, which caused the stock price to drop significantly to $80/share.

The trader then decides that it is now the right time to close the short position.

Then, the trader proceeds to buy 100 shares of XYZ on the open market for $80 per share and returns the borrowed shares to the broker.

The price of 100 shares at $80 is $8,000, so our hypothetical trader splits the difference between the initial $10,000 and the $8,000, pocketing $2,000.

Disadvantages of Short Selling

It is important to note that short selling carries some additional risks that are not present with traditional investing.

There’s no guarantee shorting stocks will result in profit because they could go up instead of down, or not move at all for an extended period.

If you hold a long position, the most you can lose is how much you paid for the stock; but if you hold a short position, your losses are potentially unlimited since there is no ceiling on how high a stock may rise.

In addition, the time frame during which the trader is borrowing and then returning these shares can be very volatile, with prices swinging wildly all over the place.

Another risk associated with short-selling in Webull is that the platform does not guarantee that you’ll be able to maintain your short position forever.

For example, if the platform cannot continue borrowing the shares, the short position might be closed without you being notified.

Aside from that, short-selling a stock at Webull carries certain restrictions and requirements.

For example, users must have a margin account with the platform and maintain a net account value of $2,000 or more.

What Is a Bad Short Position?

A bad short position is where you have sold a security at an inflated price, and when it falls in value below what you paid for it, you end up making no money on the trade and still lose out because of those costs.

How to Short on Webull

Webull allows traders to short-sell on their platform and offers some safeguards against this risk by requiring margin deposits as collateral.

You need to be familiar with how margin works when you short a stock to avoid receiving a margin call.

What Is Margin?

Margin is the collateral that an investor has to deposit with their broker, exchange, or margin account to cover the holder’s credit risk for the broker or the deal.

The collateral amount will fluctuate depending on the stock market’s volatility.

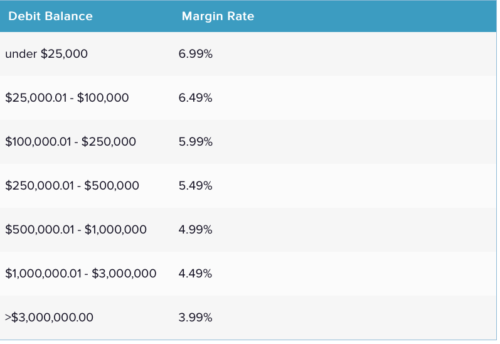

What are the Webull Margin Rates and Fees?

Webull generates income by optimizing the back-end revenue streams that every other broker (traditional or non-traditional) uses.

With a margin account, Webull provides up to four times day-trade buying power and two times overnight buying power.

To qualify, you must have at least $2,000 on hand to deposit in your margin account.

The interest on margin trades is calculated daily, credited monthly, and may vary according to the size of the margin loan.

A short position requires you to borrow shares of a company before selling them.

This includes the fee for borrowing the shares of that company to perform the short sale.

As the stock loan rate changes every day depending on the market conditions, so does the margin trading interest.

Here is the formula for Webull’s short-selling margin rate:

Daily Margin Interest (Short Position) = The Daily Market Value of the Borrowed Stocks when Market Closes* Stock Loan Rate for That Stock/360.

There are also Fees Charged By Regulatory Agencies & Exchanges

Webull does not charge commissions for stocks, ETFs, and options listed on US exchanges.

Nonetheless, SEC, FINRA, and OCC still charge fees.

Placing a Short on Webull

If you are interested in shorting a stock, here are four steps you need to take.

1. Do Your Research

Research your stock by visiting the company’s website and reviewing its financial statements.

Based on your risk tolerance level, you can also talk to a broker or an analyst about whether this is a good investment for you.

Researching before making any decisions will save you time and money in the long run.

2. Set a Short Order

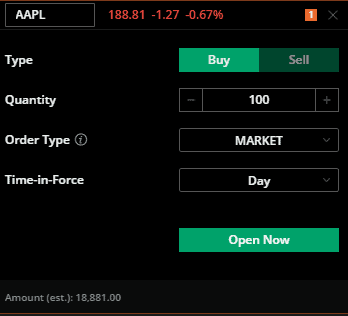

Activate your Webull account, make sure margin is turned on and you have the correct amount of funds deposited.

Create a watch list.

Go to the app’s main screen and select the stock you want to short sell.

Click the green down arrow that is next to the stock’s price.

Select the sell button, then fill in the order details.

Submit the order and wait for it to be filled.

3. Monitor Your Position

A short position is a losing proposition if the stock’s price continues to rise.

Therefore, if you consider closing your short, it’s crucial to monitor where the stock currently trades and compare that with when you initially set your order.

4. Buy Back the Stock

Once your stock price falls to a comfortable level, enter a buy order for your outstanding amount of shares.

A typical brokerage ticket will include an option to “buy to cover” — this is simply a way to close out a position and take your profit.

A short sale concludes when the cover request is filled.

After that, the platform will deduct a broker’s commission and interest from any money left in your account.

Closing a Short Position on Webull

Webull returns the shares to the lender during a short position closing by “buying” them back at open market prices.

Now, if you wish to close your short position, just place a buy order to repurchase the shares.

Can I Use the Profits from a Short Sale?

The broker sells borrowed shares on your behalf when you open a short position, but you cannot use the proceeds of this sale.

The proceeds from these shorts will be required to be returned to Webull once the short is closed.

The collateral is used to guarantee that Webull can return the borrowed shares to the rightful owner.

Marking to Market

Marking to market means that an asset’s value is marked down or raised as the price changes.

As a result, investors can see their holdings’ gain or loss.

You will receive a mark-to-market calculation for your short positions from Webull at the end of each trading day.

Using this amount, the difference between the value when you initiated the position and the value now will serve as your unrealized gain or loss.

Webull may require an additional deposit to your account if you have an unrealized loss.

This is to ensure you can close your short at current prices.

Unrealized gains (or losses) will only become apparent after closing your short position.

Can You Short on Webull: Final Thoughts

To summarize: Webull is a company that allows for the short-selling of stocks.

The process can be confusing for beginners, so we hope this overview can help you understand what it entails and how to get started with the service.

To find out whether you can short a stock on the Webull app, check to see if the stock has a purple downward arrow icon; this means that the stock can be shorted.

If you’re interested in using this service or want more information about any other financial services offered by Webull, contact them today.

>> Ready to short on Webull? Click HERE to sign up for a Webull account today! <<

Tags:

Tags: