If you’ve been paying any attention to the news recently, you’ve heard a lot of talk about short-selling stocks. And now, you’re thinking, “Can I try shorting stocks to make some quick money?” But, can you short on Robinhood? Let’s find out!

Can You Short on Robinhood?

Robinhood is one of the most popular online commission-free brokerages, and millions of people trade using its app every day.

Unfortunately, Robinhood does not technically allow direct short selling, but there are several investment strategies that let you pseudo-short a stock. So today, we want to talk about Robinhood, short selling, and how to make a profit — even if the current market falls.

What Is Short Selling?

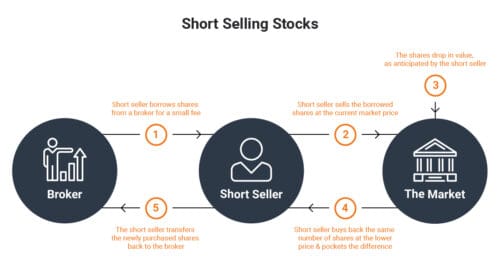

Short selling, also known as “going short,” is a trading strategy that allows you to profit when the share price of a specific stock falls.

The investor “bets” that the stock price will fall with a short sale. They place their bet by borrowing a set amount of shares from the broker and immediately selling them.

Later, when the price drops, they buy back the borrowed shares, return them, and pocket the difference.

Short selling allows traders to leverage a position on borrowed stocks when the market sells.

By borrowing stocks, you can take advantage of these price drops by selling first and then buying back the same shares at a lower price later.

Here is a simple example of how short selling works. Say that stock XYZ is currently at $20 a share and you think the price will soon fall to $10 a share.

You borrow 1,000 shares from your broker and immediately sell them at $20 a share to net $20,000.

Later, when the stock falls to $10 per share, you buy back 1,000 shares for $10,000, return the shares to the broker, and pocket the $10,000 difference.

So as you can see, the basics behind a short sale are actually pretty simple. Here is the process in four easy steps if you are still scratching your head.

-

Borrow a stock

-

Sell the stock at a high price

-

Buy the stock back at a lower price than you initially paid

-

Return the stock to your broker

-

Pocket the difference

By taking a short position, it is possible to make extremely high gains if a stock price significantly drops. In practice, the exact calculations are more complex, as you need to factor in any interest on borrowed stocks and transaction fees.

Disadvantages of Short Selling

Shorting a stock is an extremely risky investment technique. If the stock price goes up, you can take a massive loss.

Since there is an absolute bottom limit to how far a stock’s price can fall ($0), the potential gains of shorting are finite. Losses, however, are (theoretically) infinite because there is no in-principle upper limit to how high a stock’s price can rise.

So if you are going to attempt stock trading with borrowed stock, you should commit extensive research toward the companies in question.

What does a bad short position look like?

Here is an example of short sales gone wrong: Imagine the same situation before with stock XYZ at $20 a share. You borrow 1,000 shares and sell them for $20,000.

However, this time the stock price jumps to $35 a share. You now have to buy back 1,000 shares for $35,000, so you lost $15,000.

When you are dealing with very large volume transactions, these losses can grow exponentially. For example, hedge fundMelvin Capital recently lost nearly $5 billion by taking a short position on stock from Gamestop after a concerted effort led by retail investors sent the share price skyrocketing unexpectedly.

Hence why taking a short position is universally a risky position.

It should not be done unless you have sufficient capital to cover any losses. Depending on the number of shares you buy initially, you could owe more than you can cover.

However, taking a short position can also generate some profits by taking advantage of falling prices.

Can You Make a Short Sale on Robinhood?

Strictly speaking, no, you cannot short sell on Robinhood. Robinhood allows traders to have a margin account that allow borrowing stocks on credit, but they are explicitly designed to not allow shorting.

So if you want to take the traditional route of shorting stocks, you’ll need to find a brokerage that accommodates this type of action.

Robinhood margin accounts only let traders make certain options trades or borrow cash for a long position in stocks. So you cannot immediately turn around and sell borrowed shares for cash.

However, there are other investment methods that achieve a similar effect of going short. They allow you to speculate and profit when the price of a security falls.

Inverse ETFs and options are two ways to go pseudo-short on different stocks using Robinhood.

Short a Stock on Robinhood With An Inverse ETF

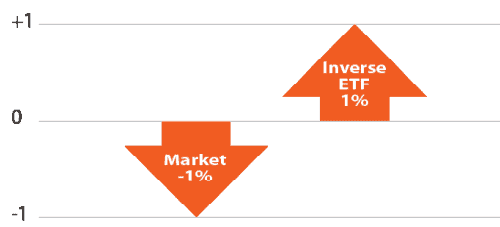

Inverse ETFs, also known as “Bear ETFs” or “Short ETFs,” are funds that are comprised of different types of derivative securities. ETFs are designed in such a way that their derivative composition will appreciate in value when the target security’s stock price drops.

In other words, inverse ETFs give you a way to make money when a stock price drops without having to sell short and put yourself on the hook for borrowed shares.

Inverse ETFs are an interesting investing option but they are still high-risk. The reason why is that derivative contracts get bought and sold multiple times a day.

This transaction volume increases derivative volatility. As such, there is no real guarantee that inverse ETFs will properly match the tracked securities.

Using Options to Short Sell on Robinhood

You can also trade options to profit when a stock’s price falls. Options are contracts that give investors the right, but not the obligation, to buy or sell a specific security.

Options trading allows you to speculate on the future direction of stock movements.

Buying Puts

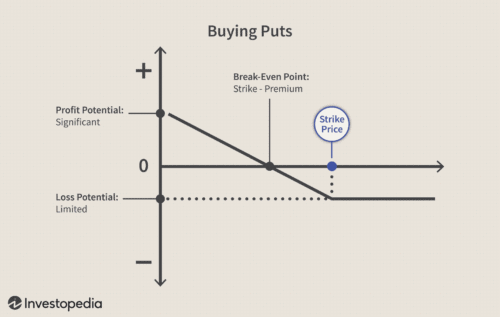

One put option contract gives you the right to control 100 shares of an underlying security at a specific price. Buying the option contract means you’re willing to buy 100 shares at the option’s strike price, while selling the options means you’re willing to sell 100 shares at that price.

The value of a put option increases as the price of the underlying security falls. One strategy is to buy puts while they’re cheap, and sell them after they’ve increased in value.

So strategically buying and selling put options can let you make money when stock prices fall, the same principle behind short selling.

At the same time though, put options decrease in price as the underlying security increases in price. In short, if you buy a put option and the security increases in price, you could lose money.

More advanced options strategies

There are also several more complex trading strategies that involve options and other derivatives, such as futures. Fair warning: any kind of derivative trading is high-risk because derivatives are highly volatile.

So we would not recommend making the bulk of your investment strategy be derivative trading.

Can’t Short on Robinhood? Use Webull Instead

If you are interested in shorting stocks directly, then you are out of luck with Robinhood, at least for the foreseeable future.

However, Webull is another online investment platform that does allow genuine short selling. So if you are looking for more trading freedom, then check out Webull for commission-free trading.

Join WeBull using this link and get two free stocks just for signing up!

Can You Short on Robinhood: Final Thoughts

To summarize: Technically, you cannot short-sell stock on Robinhood. Its margin accounts are not set up to allow the kind of trading that short-sellers.

However, Robinhood allows other trading options that have a similar principle as short selling a stock. These techniques allow you to profit when a stock price falls.

If you do want to try short selling, WeBull can accommodate your trading style, and free stock is an attractive sign-on bonus.

In general, we would recommend staying away from these kinds of speculative strategies unless you have the capital to shore up potential losses or have a lot of experience selling short and trading derivatives.

If you can’t weather the losses, your investment portfolio may take a serious hit if you lose the ability to take more stable long positions.

Tags:

Tags: