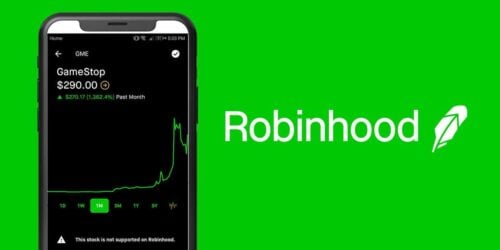

Robinhood boasts a vast assortment of stocks in the twenty-dollar range. But which ones are really worth a second look? Check out our shortlist of the best Robinhood stocks under 20 dollars for July 2025.

Best Robinhood Stocks Under $20

Gran Tierra Energy Inc. (NYSE: GTE)

Gran Tierra Energy is a Canadian company with oil and gas operations worldwide and major projects in countries like Ecuador and Colombia.

The COVID-19 pandemic hit the energy sector by interrupting the supply chain.

Also, as fewer people drove, the demand for oil prices tanked.

Global energy demand has rebounded steadily post-pandemic, supporting sustained price levels and project economics for oil & gas producers.

To be clear, the likes of Gran Tierra still continue to face threats, including the rising popularity of electric vehicles that could make oil and gas less valuable in the market.

However, these resources are unlikely to disappear anytime soon.

BlackBerry Limited (NYSE: BB)

Contrary to popular belief, the once-popular Blackberry is not dead but instead has successfully pivoted into one of the most lucrative tech fields.

Formerly called Research in Motion, this Canadian tech company used to dominate the mobile-device space until Apple’s iPhone started overtaking its models.

This technology company is also aggressively expanding in the Asia-Pacific region, partnering with huge brands like Hitachi Industry and UPS Technology in Korea to use BlackBerry Jarvis 2.0.

Financially, it currently has a market cap of $4 billion, while recent financial reports show robust margin expansion driven by recurring-license and cybersecurity-services contracts.

Investors on a hunt for cheaper stocks with a massive potential for growth can look into this old-time tech favorite.

Organigram Holdings (NASDAQ: OGI)

Besides Sundial Growers, one of the most popular marijuana penny stocks is Organigram Holdings.

Analysts forecast high-single-digit CAGR in the global cannabis market over the next decade, driven by new product formats and regulatory expansions.

It also continues to expand its product offerings, including introducing its new wellness brand called Monjour, which sells vegan-friendly cannabis soft chews.

Moreover, Organigram is a well-supported enterprise that continues to attract new investments that could strengthen its underlying business.

One of these is British American Tobacco (BAT), which has recently exercised its top-up right, adding over $6 million more into its initial investment and increasing its equity to 19.5%.

Trading Organigram could be ideal for those who want to capitalize on the growing demand of forward-thinking wellness products like cannabis.

Zealand Pharma A/S (NASDAQ: ZEAL)

This biotechnology company could be an excellent bet for investors who want to add healthcare to their Robinhood portfolio.

First, it is developing products for some of the most common metabolic diseases, like diabetes.

According to Future Business Insights, demand for metabolic-disease therapies continues to grow, underpinned by aging demographics and rising prevalence of diabetes and obesity.

Second, it could be one of the key players in peptide therapeutics, a healthcare sector whose market size could reach $516 billion in 2028.

Lastly, Zealand Pharma has an excellent market cap of almost $4 billion and has snagged a financing agreement for seven years with Oberland Capital within the next seven years.

Top Robinhood Stocks Under $20

AMC Entertainment Holdings Inc. (NYSE: AMC)

AMC Entertainment Holdings Inc., the owner of hundreds of theaters globally, used to enjoy box-office revenues — until the pandemic hit.

At the height of the coronavirus health crisis, its stock price significantly declined to single digits, but then it became one of the meme stocks of 2021.

Currently, AMC is still trying to reclaim its former glory, and while the journey isn’t rosy, it could benefit significantly from the easing of coronavirus restrictions and the growing number of movies shown in theaters.

AMC is focused on restoring theatrical attendance through partnerships with studios on premium event screenings and expanding its loyalty program to drive repeat visits.

Farmmi Inc. (NASDAQ: FAMI)

One of the unique stock picks on this list is Farmmi Inc., a China company that sells agricultural products and markets them online.

Its niche is interesting since most of the most popular stocks on Robinhood and even on major exchanges are healthcare, energy, and technology.

Nevertheless, investing in this agricultural business can be rewarding in many ways.

Its primary products include mushrooms, such as shiitake, which could generate expected revenues of over $34 billion by 2024, according to Mordor Intelligence.

Farmmi leverages longstanding relationships with domestic growers and export channels to maintain stable off-take agreements across Asia and the Middle East.

Farmmi also has standing orders from other fast-growing countries, such as Canada and the United Arab Emirates.

Dividend Stocks On Robinhood Under $20

Aegon N.V. (NYSE: AEG)

Investors who want to trade stocks and earn dividends at the same time can add Aegon NV to their portfolios.

Aegon is a Dutch company specializing in the sale of life insurance and management of assets including pensions – an industry that will significantly matter within the next few years as the population grows older.

According to AARP, the number of Americans 65 years old and above will be 70 million by 2030.

Aegon’s diversified insurance-and-asset-management model delivers consistent cashflows, supported by disciplined underwriting and a growing annuities portfolio.

Its products continue to gain momentum in the United States, while it remains stable in Europe, including the UK.

Advanced Semiconductor Engineering Inc. (NYSE: ASX)

One of the cheaper stocks trading on Robinhood that also give out dividends is Advanced Semiconductor Engineering Inc. (ASE Group).

Headquartered in Taiwan, it is one of the primary providers of semiconductors globally.

ASE is bound to continue to benefit from the high demand for its products.

Semiconductors are critical components for fast-growing technologies from the Internet of things (IoT) to self-driving vehicles, the demand for which could breach 4 million units by 2030.

Moreover, it has strong financials to support its capacity expansion.

ASE benefits from secular demand for advanced packaging and test services across semiconductors, driven by trends in AI, 5G, and electric vehicles.

Under Armour, Inc. (NYSE: UA)

Under Armour is a performance apparel, footwear, and accessories company founded in 1996 and headquartered in Baltimore, Maryland.

The brand’s core mission is to empower athletes through innovative materials and design, evidenced by its proprietary moisture-wicking fabrics and engineering-grade footwear platforms.

Under Armour operates across three primary channels: wholesale distribution to sporting-goods retailers and department stores; direct-to-consumer (DTC) through e-commerce and branded retail stores; and licensing partnerships for accessories and performance gear.

A key differentiator for Under Armour is its investment in connected-fitness platforms—such as MapMyRun, MyFitnessPal, and Endomondo—which provide user data insights that inform product development and deepen customer engagement.

This digital ecosystem complements its product lineup, fostering a community of brand-loyal athletes and driving higher lifetime value.

Under Armour has steadily expanded internationally, with a focus on the EMEA and Asia Pacific regions, leveraging local athlete partnerships and market-tailored designs.

Operationally, the company has prioritized margin expansion through supply-chain optimization, SKU rationalization, and a shift toward higher-growth DTC sales, which carry better profitability than wholesale.

Sustainability initiatives—like recycled materials in its apparel and carbon-neutral sourcing targets—align with consumer and regulatory trends, further enhancing its brand appeal.

While the athletic-apparel sector remains competitive, Under Armour’s blend of product innovation, digital integration, and disciplined cost management positions it for steady, long-term growth under the $20 threshold.

Should You Buy Stocks On Robinhood?

If you’re going to trade 20-dollar stocks, Robinhood could be a great place to start.

The company operates on a commission-free basis, provides free stock, has a user-friendly interface, and permits investors to buy fractional shares.

It’s also regulated by the Securities and Exchange Commission.

Like Webull, Robinhood is a trading platform that allows retail investors to buy and sell stocks anytime, anywhere.

Robinhood supports:

- Cryptocurrency trading

- Blue-chip stocks

- Penny stock

- Exchange-traded funds

- Options

One drawback to using the platform is that you cannot trade stocks on over-the-counter markets.

Low-priced stocks like these cater to a niche group of traders, so this might not bother most folks.

You can still find cheap stocks for just a few dollars, but they’ll need to be listed on major exchanges for Robinhood to broker them.

Another downside is that Robinhood does not support short selling.

There’s always Webull if you want to short sell, though.

Still, there’s a lot to like about Robinhood, which is why so many retail, margin, and growth investors trade on the platform.

How to Find Stocks Under 20 Dollars on Robinhood

One of the primary advantages of using Robinhood is the ease of finding penny stocks.

If you want to do a broad search, you can check out the categories for stocks in specific sectors.

On the other hand, if you know what stock you want to buy, you can enter the ticker, and it will pop up.

You can also check the Trending Lists for popular stocks.

Some Robinhood stocks may be unsearchable, and this could be because they are OTC stocks or have been delisted on major stock exchanges like NASDAQ or New York Stock Exchange (NYSE).

Robinhood Stocks Under 20 Dollars: Final Thoughts

Robinhood is an excellent platform for trading stocks under 20 bucks.

Few brokers offer the same level of accessibility and options for trading; so if you’re new to the stock market, this platform could be your best bet.

Between trading penny stocks, blue chips, crypto, and more, you’ll have plenty of investment options to keep you busy.

As always, make sure you do your due diligence when investing — and this includes the picks on our list.

Robinhood Stocks FAQs

Can You Sell Stock Immediately After Buying on Robinhood?

You can sell a stock right after you buy it. But you are not allowed to buy and sell the same stock more than four times within five business days.

How Long Do I Have to Keep My Money in Robinhood?

You typically need to wait five business days after you’ve moved money into your Robinhood account to take it out. It’s not the longest waiting period, but you may want to think twice before depositing it if you really need the cash.

Is Robinhood Good for Beginners?

Most regard Robinhood as the best platform for beginners. Signing up and finding a stock is easy. That being said, you trade accessibility for functionality, as it lacks some of the more robust analyst tools.

What Is the Catch with Robinhood?

There are no catches with signing up and using Robinhood. The terms are transparent, and it charges zero commission fees for stock trading.

How Much Is Robinhood Monthly Fee?

Although it is a no-commission platform, Robinhood charges $5 monthly at the start of the billing cycle. If your margin is over $1,000, you may have to pay 2.5% annual interest on the margin amount beyond $1,000.

Tags:

Tags: