Growth stocks are usually more popular when the economy is booming, but what happens when high inflation starts to hurt market sentiments? Do value stocks do better in inflation, and can you use them as a hedge against it? Let’s find out.

A Bit About Value Stocks

Value stocks are typically large companies with steady cash flows that do not perform as per their potential on key financial indicators.

These indicators could include price-to-earnings ratios, cash flow ratios, or book value.

Companies classified as “value” typically include utilities, healthcare firms, or other sectors where goods and services are always in demand, even if the economy is doing poorly.

They are characterized by low yet stable cash flows and steadier actual returns than the market.

These stocks do especially well during periods of economic turmoil and under bearish market conditions.

Do Value Stocks Do Better in Inflation?

Yes, if you look at past performance, value stocks have always done better during periods of rising inflation as compared to growth stocks.

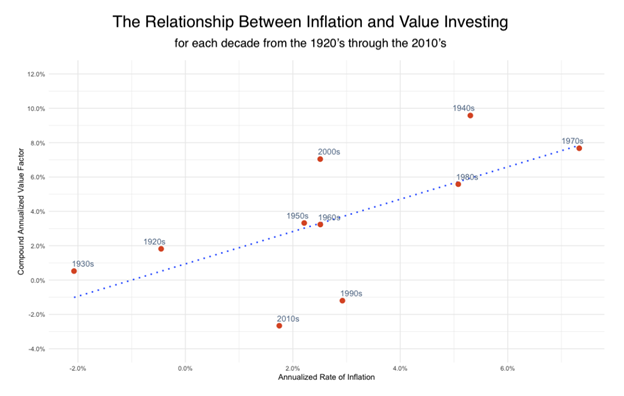

In a comparison between returns from investing in these stocks and the inflation levels during the last century, a clear historical relationship is visible.

This suggests that such stocks can be a powerful hedging strategy for traders who expect a period of high inflation coming up.

Why Do Value Stocks Do Better in Inflation?

High inflation periods make money in hand more valuable than future earnings.

This makes value stocks (which have steady, current cash flows) more attractive than growth stocks (which have high future potential but low current profits) to investors.

Inflation is a sustained rise in prices of goods and services and is measured as the change in the consumer price index against its measure in the same period last year.

Inflation erodes the worth of money, stocks, and investments.

The farther away the money is in the future; the more its worth is reduced when inflation rises. This causes growth stocks to decline during high inflation.

On the other hand, value investing focuses on buying stocks with steady current incomes. This is why, in an inflationary environment, these stocks perform better than growth stocks.

Do Value Stocks Go up When Interest Rates Rise?

Yes, value stocks go up with rising interest rates.

When interest rates go up, the risk-free return rate against a company’s potential profits is measured and also increases. This reduces how much future earnings are worth.

For growth companies, which derive their worth based on the expectation of high future performance, this causes a significant fall in valuations.

Over time, traders in the stock markets realign the stock’s price with the company’s valuation by reducing it.

Value companies already generate steady cash flows, so their prices do not decline as badly when interest rates go up.

Which Stocks Do Well in Inflation?

Value stocks and dividend stocks often do well during high inflation periods, whereas penny stocks and growth stocks decline.

These securities tend to do better during high inflation periods because inflation reduces the worth of money in the future and makes steady current cash flows more attractive.

On the other hand, growth stocks rise during low inflation because investors look to buy into high future potential, which can offer a better return than steady and less volatile stocks.

Penny stocks don’t do well when high inflation is around the corner. Penny stocks have volatile returns, and investors prefer surer bets when purchasing power is low.

Dividend stocks pay back a portion of the company’s earnings (known as dividends) as a reward to investors.

During periods of high inflation, this reward tends to go up, which increases the return that an investor gets from a dividend stock.

However, the dividend spent is actually a loss for the stock price. Any money the company pays investors gets permanently deducted from its balance sheet.

Still, dividend-paying stocks tend to do well during inflation because the dividend they give out is quite significant, and during inflation, investors prefer the additional income.

What Industries Do Well During Inflation?

Real Estate, precious metals, and the energy sector usually outperform during inflation. Industries such as healthcare also grow when prices are rising.

If you don’t want to invest in real estate directly, real estate investment trusts (or REITs) are another good option.

These are companies that have ownership of commercial or residential properties. They rent out these properties to earn money.

REITs do well during inflation because rentals go up with the prices of other goods, but they don’t have to bear the rising cost of building materials because their properties are already built.

Another sector to watch out for during high inflation is energy.

Whatever the price, consumers still need electricity, so these companies become more profitable by passing on their costs to consumers.

Mining companies that extract precious metals also do well with inflation.

Prices of gold and other precious metals rise when inflation goes up because investors consider these safe havens. Mining stocks capitalize on this rise in prices.

Another good option is to invest in Exchange Traded Funds (ETFs). ETFs track indexes related to specific industries.

So if you don’t want to invest directly in mining or real estate stocks, ETFs are a good option.

How to Invest If Inflation Rises?

Investors should buy assets whose returns will go up when inflation rises. This includes real estate, precious metals, commodities, value stocks, and inflation-indexed bonds.

Real estate prices typically go up with inflation, and so do rentals. Investors buy REITs during inflation because these are easier to buy and sell than actual real estate.

Prices of precious metals like gold and silver increase during high inflation because their value appreciates with rising prices.

Other commodities such as oil and agricultural products, like corn or soybean, also see an increase in prices with rising inflation.

Their prices move in tandem with that of the finished goods made using them.

Fixed-rate bonds depreciate with higher inflation, which makes their future payouts less valuable.

However, inflation-indexed bonds, such as Treasury Inflation-Protected Securities (TIPS) are a good option to invest in at such times.

These bonds offer inflation-linked payouts rather than fixed payouts. And, with rising inflation, their base also increases.

Value stocks also see better returns during high inflation periods because they belong to companies whose products are needed no matter the economic condition.

Such companies can pass on price rises to consumers, making them suitable investments when prices rise. Some examples include utilities and healthcare stocks.

Who Benefits from Inflation?

Businesses that can raise prices during inflation can profit from it. Typically, stock prices of such companies grow during these periods as well.

If a business can charge higher to its customers than the rise in its input costs, its profit margins will go up, making it more valuable to investors.

Sectors such as real estate can do this by increasing rentals.

Similarly, commodities can immediately increase in price when inflation hits the supplier countries, and companies who deal with them benefit from this price rise.

However, many businesses cannot pass on price rises to consumers, and that can be why such companies suffer when inflation rises suddenly.

For example, if the government controls specific drug prices, the pharma companies that own and market those drugs will lose out if inflation increases.

Do Growth Stocks Do Well During Inflation?

No, growth investing typically does not do well during inflation because it erodes the value of the future earnings on which the prices of these stocks depend.

These companies’ actual profits or cash flows don’t necessarily reflect their future potential. Investors judge them on their ability to grow rather than their current profitability.

But when inflation increases, those future earnings become less valuable.

While this impacts both value and growth stocks, the farther away the earnings are, the more pronounced the loss is in value. Hence traders start to lower the prices of these stocks.

Can Inflation Cause a Stock Market Crash

High inflation impacts the stock market in many ways, including reducing the valuation of companies, increasing volatility, turning investor sentiment negative, and causing a decline in stock prices.

Inflation reduces the purchasing power of consumers, which is when the Federal Reserve steps in trying to control it by increasing interest rates.

When interest rates rise, the valuation of companies using the discounted cash flow method fall, causing a gap between market capitalization and actual valuations.

Traders try to balance this gap by gradually lowering stock prices.

Growth stocks suffer more because they have lower current revenues, so their valuations fall more.

At the same time, inflation causes a decline in economic activity because consumers become more careful about spending when prices increase.

When the economy stagnates, investor confidence also declines. This, again, has a negative impact on stock markets.

If there is continued sluggishness in the economy, there might also be fears of recession, which causes investors to move out of riskier investments such as equities.

To summarize, consistent, high inflation is bad news for the stock markets.

Final Thoughts: Do Value Stocks Do Better in Inflation?

Inflation reduces the purchasing power of money, and the farther away that money is in the future, the more erosion in its worth.

Value stocks offer steady cash flows and are a stable hedge when inflation begins to erode your investment’s worth.

Specific sectors, such as real estate and commodities, can do better during inflation because they pass on the rising prices to consumers.

Rising interest rates also have a similar impact on stock markets to inflation because higher interests raise the cost of borrowing, which reduces the valuation of companies.

The more a company’s potential lies in future earnings, the higher the impact. This is why interest rates negatively impact growth stocks while not affecting value stocks.

Sustained, high inflation is very bad for the stock market and the economy as a whole. It causes consumers to buy less, reducing demand, which makes businesses less profitable. As profits fall, so do stock markets.

Tags:

Tags: