Penny stocks are risky investments with the potential for some serious returns. But how many penny stocks should you buy to make the most out of your investment? Read on to find out.

How Many Penny Stocks Should I Buy?

The number of penny stocks you should buy depends on several factors, including risk appetite, investment capital, and confidence in the stock’s potential.

There’s no right answer for all investors. Each trader can choose to add these stocks to their portfolio based on their unique investment profile.

Many opt out of trading penny stocks entirely, as it requires a different skill set than most investment strategies.

We will share below some thumb rules that will help you mitigate the risk involved in buying and selling penny stocks.

In addition, we will also answer a few questions that will clarify some doubts that you may have while trading penny stocks.

How Much Should You Put Into Penny Stocks?

Many experts recommend only allocating about 5% to 10% of a portfolio to riskier investments, including penny stocks.

This does not mean, however, that it’s wise to dedicate 10% of a portfolio to penny stocks. Other speculative investments could make up a blend of this percentage, such as crypto.

Also, the 5% to 10% rule is just a general guideline. Many investment portfolios leave out penny stocks entirely.

On a wide spectrum of investment choices ranging from low risk (government bonds) to high risk (crypto and some derivative instruments), penny stocks are near the riskiest end.

Therefore, it is possible to lose your entire investment in a bad penny stock trade.

Most investors will be devastated if more than 10% of their capital gets wiped away, so it is not advisable to go beyond this limit.

That’s, of course, assuming that you have the stomach to lose even that much. If not, it is safer just to watch risky assets, like cryptocurrencies and penny stocks, from the bylines.

You won’t be alone — many traders never put money into these instruments.

What Percentage of Penny Stocks Succeed?

The majority of penny stocks don’t succeed. There is no guarantee that penny stocks will grow into successful companies in the long run.

That’s not to say that penny stocks never succeed (we will cover some big ones that blew up), but as an investor, you need to understand the risks involved.

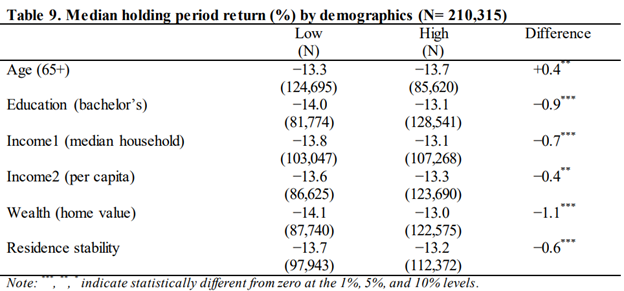

As per a report by the US securities exchange commission on over-the-counter markets (OTC markets), which are overwhelmingly composed of penny stocks, the median stock gave the investor negative returns (-37%).

However, it is also important to understand that the ultimate success of the company is not a big factor for those who invest in penny stocks.

Many traders are not looking for the next big Amazon or Apple in these stocks anyway. Instead, they create short-term positions and try to exit as soon as there is a significant upswing in prices.

Can You Get Rich off Penny Stocks?

You could technically get rich off penny stocks. However, it’s not a likely outcome for most people.

As per the SEC report that we quoted earlier, the median investor lost money over their holding period in the penny stock market.

Penny stocks are attractive because they are volatile, and small swings in value could become huge gains in percentage terms. But that’s as much a recipe for disaster as it is for success.

That said, you can minimize the risk by following healthy investment practices.

Start by evaluating the company’s fundamentals. Understand key indicators such as price-to-Earnings (P/E ratios), stock volume, and float.

Study key catalysts that can create big movements in the stock price, such as favorable changes in government regulation, positive financial results, M&A buzz, and so on.

Even if you are confident that the stock’s movement can be predicted, make sure to limit exposure and exit quickly if the price starts to fall precipitously.

What Is the Most Successful Penny Stock Ever?

Here is a list of five of the best companies that were traded as penny stocks:

- Amazon

- Ford Motor Company

- GameStop

- Advanced Micro Devices

- Plug Power

Amazon debuted on the New York Stock Exchange (NYSE) in 1997 with an $18 stock price but then saw three stock splits over the next two years.

These splits reduced its price momentarily; however, Amazon never truly became a penny stock. Today, it trades at nearly $127 and is one of the most successful companies in the world.

Ford Motors has twice gone to sub $5 prices, once in 2008 (during the subprime crisis) and again in 2020 due to the bear market in the wake of the pandemic.

GameStop was a true penny stock “rags to riches” story, going from $4 in 2020 to as high as $325 at one point in 2021. This was fuelled by retail buying.

AMD is the David to Intel’s Goliath. As recently as 2016, AMD was trading below $5. But recent market share increases suggest that it has broken out of the penny stock category.

Plug Power is in the hydrogen fuel cell business. This is a volatile penny stock that has seen plenty of ups and downs and has traded both above and much the $5 mark many times.

Is Buying Penny Stocks Worth It?

Penny stocks could be worth it if you are committed to learning how to trade them.

However, for most investors, trading penny stocks is likely not worth the trouble. Profiting from them isn’t impossible, but it requires a lot of due diligence and risk-taking abilities.

It can be challenging to invest in penny stocks because most of them trade as pink sheets on the over-the-counter markets, rather than on major exchanges.

For these stocks, there is very little information available to gauge their quality most of the time. That’s why it is better to trade penny stocks listed on major exchanges only.

Stock exchanges such as the NYSE enforce financial reporting norms that help you analyze the stock before investing.

Another risk to consider is the dreaded pump and dump.

Some try to buy penny stocks at low prices but in big numbers, fuelling speculation that the stock is rising (this is called pumping the stock).

Then, they sell the stock when the price is high (or “dump” the stock).

Smaller penny stock buyers often lose out in these pump-and-dump schemes because they buy when the stock is rising and end up selling when the price suddenly crashes.

This is another reason why some investors stay away from penny stocks.

Is It Difficult to Sell Penny Stocks?

It can be difficult to sell penny stocks on the OTC market, but those listed on major stock exchanges are more accessible.

Major online trading apps such as Robinhood and Webull do not support trading in pink sheets.

Apart from this, it is important to regularly check stock volumes and price fluctuations when selling penny stocks. This information is difficult to obtain for over-the-counter markets.

Where Can I Trade Penny Stocks?

Online trading platforms are making trading penny stocks more accessible than ever. Even better, there are tons of viable options to choose from.

Here is a list of online trading apps where you can trade in penny stocks.

- Robinhood is one of the biggest mobile trading platforms in the US. It lets users trade penny stocks listed on major stock exchanges such as the NYSE or NASDAQ.

- TradeStation‘s latest trading service, TSGo, does not charge any fees for trading penny stocks. It also has many tools for researching penny stocks.

- ETrade also has a $0 fee structure. It lets you trade penny stocks on OTC markets.

- TD Ameritrade lists penny stocks from FINRA’s OTC “bulletin board.” FINRA is a government agency that oversees broker-dealers, which is why this list is more reliable when investing in penny stocks.

- Charles Schwab is one of the most reputed brokers in the trading world. Its suite of trading analysis tools helps you analyze penny stocks carefully before investing.

These are just some of the options you can choose from to trade penny stocks. There are many more.

If you’re new to trading, Robinhood could be a great place to start. It offers quite a bit of functionality and only deals in penny stocks listed on major exchanges, like the NASDAQ and NYSE.

Webull is not on the list above, but it occupies a similar space in the trading world. That said, some newer users find it to be a bit more complicated than Robinhood.

You could make money from buying one share of a stock, but profit potential is limited. Even if the stock grows significantly, you will get a modest profit.

For example, let’s assume that a stock priced at $1 grows to become a $100 stock. At best, you would have made $99.

Most likely, the stock would take several years to reach there, so real returns per annum would be much lower.

That’s why, when investing in penny stocks, it is important to buy in multiple lots.

How Many Penny Stocks Are There?

There are more than 10,000 shares that are traded as penny stocks, as per a New York Times report from 2021.

Many penny stock companies are not listed on any stock exchange, so it is harder to set a single number to how many such stocks there are.

Those trading in penny stocks should keep this in mind and not get drawn into risky bets just because they think that they might miss out on a profitable trade.

A lot is a number of fixed units of a security.

Traditionally, shares have been sold in round lots, which includes 100 shares per lot. Even shares that are in multiples of 100 are considered round lots.

When someone buys shares in numbers other than round lots, it is called an odd lot.

Historically, brokers used to charge extra commission for processing the sale of odd lots because no one was willing to buy them.

Over time, this meant that more and more investors started avoiding odd lots.

Today, despite all trading having moved online, traders continue to avoid trading in odd lots and prefer multiples of round lots.

Final Thoughts: How Many Penny Stocks Should You Buy?

If you are buying penny stocks, it is a good idea not to invest more than 5-10% of your total capital.

Most penny stocks are volatile and risky financial instruments, so be careful when trading them.

Study the company’s fundamentals before buying in. Some of the best penny stocks were the ones that had a sound and viable business model and a great management team.

Even if a stock looks like a sure win, avoid investing a lot of money in it at once.

External factors often impact penny stock prices significantly, so despite putting the best efforts into analyzing a stock, you could still end up losing money on it.

Only buy stocks listed on a major exchange, and steer clear of penny stocks.

Try to avoid day trading penny stocks unless you are absolutely sure of the key catalyst events of the day.

Look for consistent signals, such as regular increases in the volume of trading and stock price over a period of time to evaluate a penny stock.

Try not to fall for media speculation and promotion of a company trading in the penny stocks market.

Often, such promotions are used to artificially jack up prices so that market makers and company insiders can benefit from trading the stock.

Once you zero in on a penny stock, make sure to buy enough lots to make a good profit. Small investments in penny stocks will not yield much more than a modest profit.

Lastly, investors who do not have the risk appetite should avoid penny stocks entirely.

History tells us that most traders do not make money from penny stock companies, despite whatever promise they might hold.

Tags:

Tags: