Investors have gone from thriving to surviving after a disappointing year for the S&P and the markets as a whole. Fortunately, they might find protection by adopting a defensive ETF strategy in their portfolios, but which ones do you choose? Let’s check out the best defensive ETFs available to buy now.

Best Defensive ETFs

Utilities Select Sector SPDR ETF (NYSEARCA: XLU)

Investors favor utility stocks during a market downturn for their inherent ability to generate revenue despite economic conditions.

Utility bills are among the few that get prioritized during difficult times. While companies and individuals may seek to keep their utility bills under control, most won’t keep the lights off.

As its name suggests, the Utilities Select Sector SPDR Fund seeks to track the performance of the utility sector of the S&P 500.

The ETF comprises energy companies and utility stocks such as NextEra Energy, Duke Energy, Southern Company, and Sempra Energy.

XLU has been on a solid upwards trend since it picked up momentum after the 2008 recession, and it’s not showing signs of slowing down.

The sector also benefits from the rising energy costs and the European energy crisis, which supports its growth narrative.

The Utilities Select Sector SPDR ETF is the largest utilities tracking ETF in the stock market. The fund manages over $15 billion in assets.

Investors can expect to be compensated well for holding the ETF. The fund has a dividend yield of 2.86%.

XLU also has considerably low maintenance costs, setting back investors a mere 0.10% in expense ratio.

Vanguard High Dividend Yield ETF (NYSEARCA: VYM)

Dividends might help compensate for the lack of growth during a bear market.

Investors tend to flock to high-dividend stocks and ETFs to help defend against the challenges of a market downturn.

While many high-dividend exchange-traded funds are out in the market, VYM tops our list for its compelling maintenance fees.

Low expense ratios could save investors a fortune over long periods, and Vanguard is well known for its low-cost ETFs.

VYM has an expense ratio of 0.06%, comparably low when the average for similar funds is 0.91%.

For this list, we have decided to go with VYM over the Vanguard Dividend Appreciation Fund (VIG) because of its composition.

VIG is more weighted toward tech than VYM, with companies such as Microsoft (MSFT) and Visa (V) among its top investments. Given tech is so heavily affected during this economic downturn, VYM makes a better defensive ETF.

VYM is a Vanguard fund that seeks to track the performance of the FTSE High Dividend Yield Index.

The ETF pays investors a dividend of nearly 3% and has also shown strength regarding its price action. The ETF is up 2.52% on a year where most equities are down.

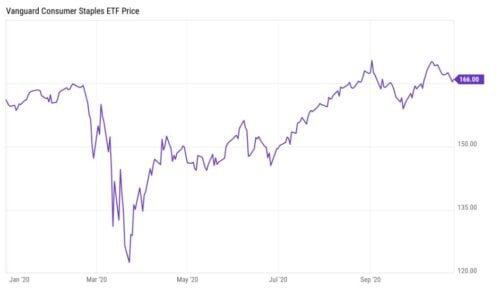

Vanguard Consumer Staples Index Fund ETF (NYSEARCA: VDC)

Consumer staples are another sector considered as defensive investments.

Consumer staples are always going to be in demand. In fact, we don’t need to look too far back to observe the value of consumer staples.

The pandemic might have unraveled the consumer’s critical need for specific items. We can all probably remember the toilet paper shortages that occurred as consumers panicked and bought the essential product.

VDC seeks to track the performance of the MSCI US Investable Market Consumer Staples 25/50 Index. The index tracks US small to large-cap stocks in the consumer staples sector.

Like VYM, this ETF also has an ultra-low expense ratio of 0.10% and a dividend yield of 2.21%.

The fund’s largest portfolio holdings include defensive stocks such as Procter & Gamble (PG), PepsiCo (PEP), and Coca-Cola (KO).

VDC has also maintained its technical structure and has been on an uptrend since the last recession.

Invesco S&P 500 Low Volatility ETF (NYSEARCA: SPLV)

If your nerves go over the edge every time the market drops, then SPVL could be the fund for you.

SPVL offers a different way to protect against market downturns. Low-volatility ETFs tend to move more passively, which helps avoid the extremes of the stock market.

Investors could use low-volatility strategies to reduce losses during economic downturns. These strategies could offer a more comfortable ride with better performance.

The fund achieves its market volatility goals by maintaining a diversified portfolio with low expected future volatility. SPVL holds the top 100 S&P stocks with the lowest realized volatility over 12 months.

Investing in this ETF offers investors a fairly diversified footprint in the US equity market.

The fund’s expense ratio is higher than our previous picks yet lower than most ETFs. SPLV charges investors an expense ratio of 0.25%.

The fund has performed well since its inception, delivering around 12% yearly average returns.

SPLV has also maintained its upwards trendline despite the economic downturn.

Unsurprisingly, the fund comprises mainly defensive stocks in the utilities (26%), consumer staples (22%), and healthcare sectors (15%).

Fidelity MSCI Utilities ETF (NYSEARCA: FUTY)

FUTY is our second utility fund on the list of best defensive ETFs because we couldn’t get enough of this sector.

The Fidelity MSCI Utilities ETF seeks to track the performance of the MSCI USA IMI Utilities Index.

The Fidelity fund has a very similar composition to XLU. It’s comprised of companies such as NextEra Energy (NEE), Duke Energy (DUK), Southern Company (SO), and Dominion Energy (D).

FUTY has also had a similar performance to XLU, except its price history does not go as far as the S&P fund.

Fidelity has a competitive advantage over XLU, as its expense ratio is slightly less, coming in at 0.08%.

However, despite the lower expense rate, FUTY falls behind in its dividend distribution. The fund offers a slightly lower yield of 2.76%

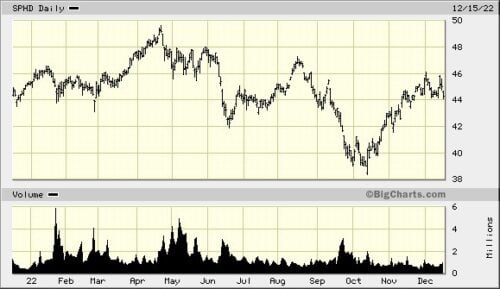

Invesco S&P 500 High Div Low Volatility ETF (NYSEARCA: SPHD)

SPHD combines two defensive investment strategies by offering low volatility and high dividends.

The S&P fund seeks to track the performance of the S&P 500 Low Volatility High Dividend Index.

SPHD holds most of its positions in defensive sectors, which we have covered in this article. Utility, consumer defense, and healthcare stocks are among its top holdings.

All of these sectors are also well-positioned to deliver dividend growth.

The fund has a short price history, going back only to 2013; however, it has maintained steady growth since then.

Although it claims low volatility, it’s notable that the fund was down nearly 45% during the 2020 pandemic sell-off. This was considerably more than the 36% and 38% that the S&P and SPLV fell, respectively, during the same period.

This higher volatility range was likely due to its composition, as its top holding sector is real estate (19%). The real estate sector was hit badly during the 2020 selloff, as businesses had to close their doors.

However, it’s possible that the ETF could show more resilience during various crises. SPHD lost only 22% of its value during the last market downturn. Comparably less than the S&P, which lost close to 28%.

The high-dividend fund offers investors a yield of 2.24%, falling slightly behind VYM.

Are Defensive ETFs a Good Investment?

Defensive ETFs could offer investors resilience during challenging economic times and steady growth during bull markets.

A defensive fund might not grow as aggressively as a growth fund, but it offers considerable stability.

Defensive funds are considered to be non-cyclical. They tend to be invested in sectors that are less sensitive to the ebbs and flows of the economy.

Sectors such as utilities, consumer staples, and healthcare are considered defensive. These industries are also considered to be recession-proof by many analysts.

Perhaps, there isn’t as much of a thrill in consumer defensive stocks. More adventurous investors may find sectors like tech and crypto more interesting.

But these “boring” defense plays could also pay handsome and steady returns.

Considering how many tech companies have wiped out their recent gains, one must ask—was the juice worth the squeeze? Could a “boring” investment have yielded better long-term results?

Given their low volatility and steady growth, defense ETFs could work particularly well for investors with less risk tolerance. If big-red market days tend to easily scare you out of your trades, a low-volatility ETF could help take off the edge.

Defensive stocks could also perform notably better during an economic slowdown as investors tend to flock to them.

Defensive ETFs could form a part of a sound investment strategy even during bull markets. They don’t necessarily have to only form part of a market downturn strategy.

Many of the price charts observed in this article tell a story of continuous growth since the last economic recession.

Investors could benefit from an extra layer of protection by purchasing defensive exchange-traded funds instead of defensive stocks.

ETFs spread their risk across multiple companies, making them less volatile and susceptible to negative news or poor individual performance.

Exchange-traded funds also help investors stay more passive. They might benefit those who don’t have the time to follow the market beat. ETFs are managed by funds that take care of the heavy lifting and manage the portfolio composition.

While defensive ETFs offer considerable stability, no investment is ever 100% safe. It’s possible that during extreme stress and insecurity periods, even these defensive plays could underperform.

Now that you know more about defensive ETFs, you might add one (or more) of these to your portfolio.

You might also like:

The 7 Best Cybersecurity ETFs To Buy Now

The 8 Best 5G ETFs To Buy Now For Huge Upside

Tags:

Tags: